What Are the Benefits of Scoring Your Customers?

To make reasonable decisions based on individual customers' payment progress, you need a customer scoring system.

Scoring a customer according to his payment behavior gives you a range of opportunities:

- to assign an optimal workflow for a particular customer/group of customers

- to provide credit limits and terms based on customers’ payment history

- to identify customers’ payment patterns and trends

- to compare the customers with one another

- etc.

CPS: Brief Overview

Basically, the Customer Payment Score (CPS) is interpreted as:

an average number of days taken by a customer to pay his invoices after the due date.

The lower the better.*

Based on the CPS value, the values for A, B, C, or D labels will be automatically set (see the table below).

Table. ABCD ranges:

| Letter label | Score | Range | Meaning |

|---|---|---|---|

A |

Excellent |

<15 |

A customer pays on average no later than 15 days after the due date (or even before the due date) |

B |

Good |

from ≥15 to <60 | A customer pays on average no later than 60 days after the due date, but later than 15 days |

| C | Bad |

from ≥60 to <90 |

A customer pays on average no later than 90 days after the due date, but later than 60 days |

| D | Poor |

≥90 | A customer pays on average 90+ days after the due date |

* The final score is cut off to be within the interval from 0 to 90.

The ABCD labels are displayed in the “Score” column on the Aging Report page.

The up and down arrows reflect the dynamics of customers’ payment behavior since the last update (updates take place once a month).

For a detailed description and extended options of the given score see the next section below.

CPS: without Machine Language Payment Scoring Configuration Enabled

The payment score shown for each customer in YayPay is derived based on the history data of closed invoices and payments data & dates synced/imported from the ERP, as well as the accumulation of new history as and when open invoices are also updated to closed with the applied payments integrated/updated in YayPay.

CPS: Detailed Explanation with Machine Language Payment Scoring Configuration Enabled

In CPS calculation you can use data either on closed invoices only or incorporate open invoices data as well.

-

closed (paid) invoices

The score covers all closed invoices per the selected look-back period.

The look-back period can be customized starting from 1 month upward.

Also note, that you can preset the minimum number of paid invoices to be taken into calculation, and the system will search for this minimum number of invoices even outside the selected look-back period. This is helpful in scoring the customers with no payment activity during the chosen period.

-

open (unpaid) invoices

The ability to include open invoices into the final score calculation is presented by a separate option - “Include open invoices in scoring”.

However, only those open invoices are included that potentially impair the score obtained from the closed invoices data.

The reasoning is as follows: open invoices that potentially impair the score (overdue invoices) already bear information about the customer’s paying behavior, i. e. we can predict they will downgrade the obtained score (based on closed invoices) even if they are paid the current day.

Thus, the score becomes more accurate, though we have no information as to when the payments for overdue invoices will be submitted.

“Use money weighting” option: takes into account the invoices' total amounts. When this option is enabled, the system measures each closed invoice’s “contribution” into the final score in terms of the money paid.

In practice this may result in the following: when the money-weighted score is less than the initial score, this means that larger invoices typically take a shorter time to pay if compared to all invoices.

Example:

A customer has one closed invoice during the selected period. This invoice was paid 20 days before the due date.

CPS based on closed invoices only is given by:

CPS = -20

In case the customer also has one open invoice, which is already 30 days overdue, the score is expressed as:

CPS = (-20 + 30)/2 = 5

As seen, the open overdue invoice has increased the customer’s score.

Example:

Let’s assume we want to score a customer who has two invoices: for $1000 and $10 000, respectively. The first invoice was paid 10 days before due. The second one is open and overdue for 30 days.

For the computation of the customer’s score in the given example, you may use the option "Include open invoices in scoring" (because we do have an open invoice in this example).

The score is expressed as:

CPS = ((-10*1000 + 30*10000)/(1000+ 10000)) = 26.4

How to Configure Customers' Payment Scoring

Go to Settings > Business > Machine Learning Payment Scoring section:

- enable the checkbox "Enable ML payment scoring"

- enable the "Include open invoices in scoring" checkbox if you wish to incorporate open (unpaid) invoices in scoring.

- enable the "Use money weighting" option, if required (e.g. when the invoice totals are significantly different)

- enable "Exclude disputed invoices" and/or "Exclude invoices closed by credits or adjustments" if you do not want those to be considered in the calculation.

- enable the "Exclude partially paid invoices" option if you do not want those to be used in the calculation.

- "Aggregate to Parent": enable, if you have customers with their own child company/companies, and you would like to have their payment score aggregated based on the parent/child relationship.

- type in the "Look-back period" in months.

- set the "Minimum number of closed invoices" for the system to look for within the given look-back period.

- click SAVE.

The saved options will apply to all your customers.

Use Cases (Examples) of the Different Configuration Setup

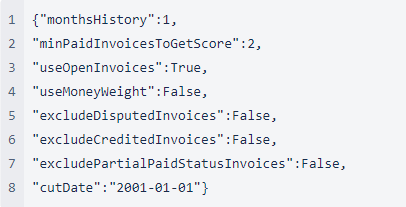

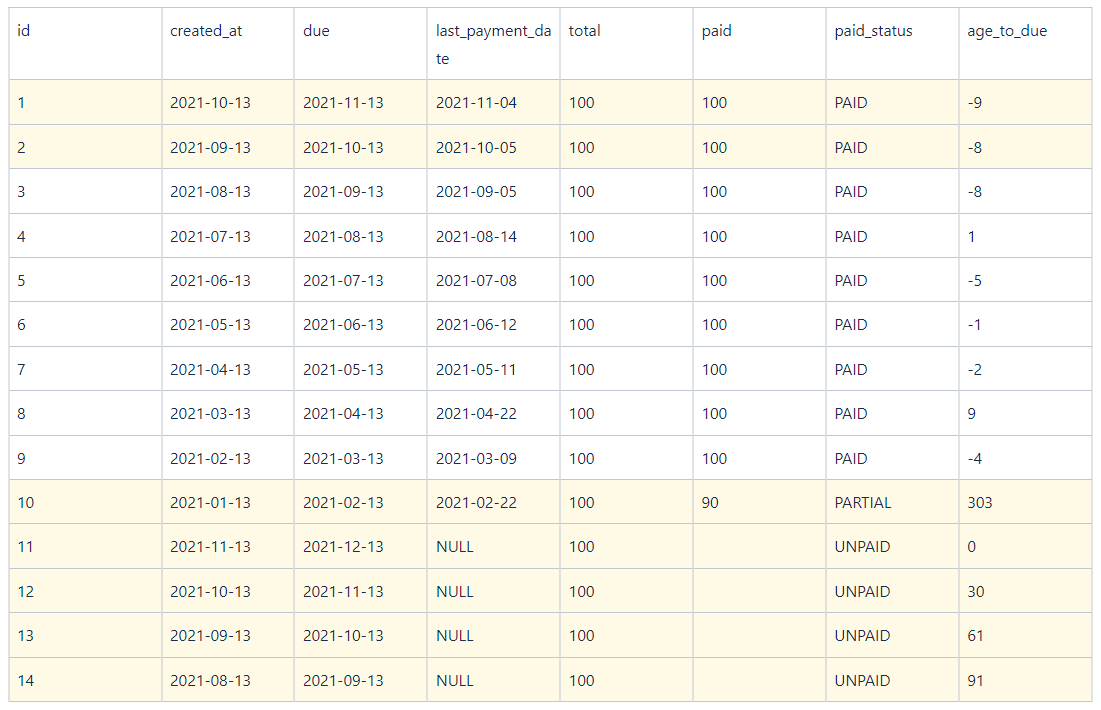

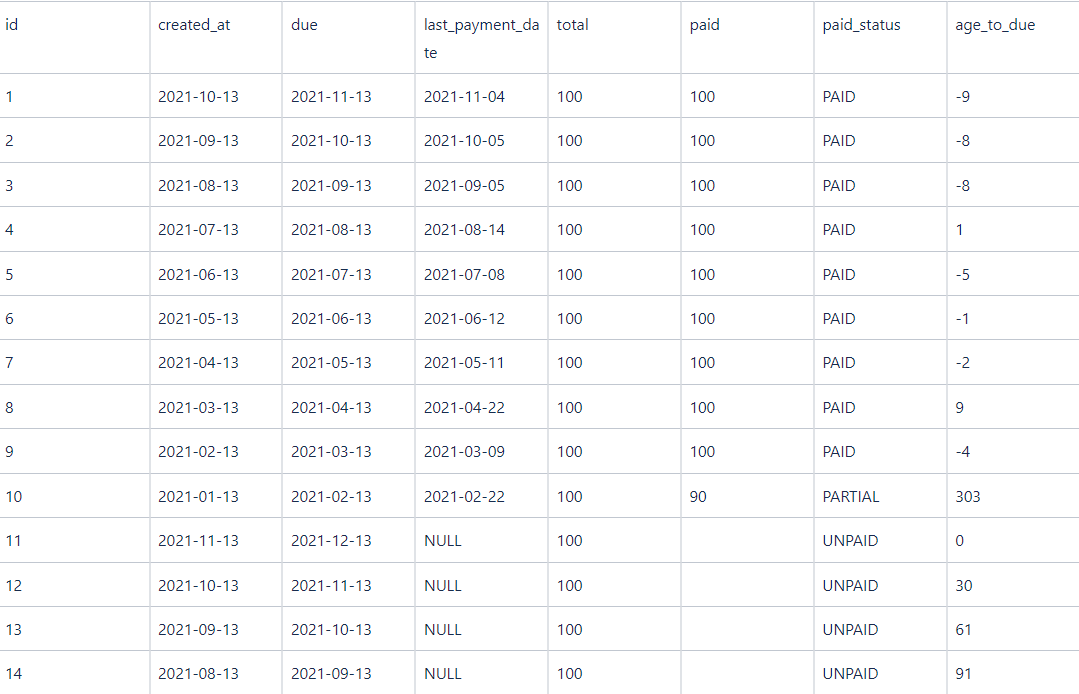

Case 1

monthsHistory=1 and there are no paid invoices over that period, but as minPaidInvoicesToGetScore=2 we will use 2 last paid invoices to calculate the score.

Avg age_to_due for those 2 paid invoices equals -8.5. Since useOpenInvoices=True we will use all open invoices with current age_to_due>-8.5.

Score 66.86

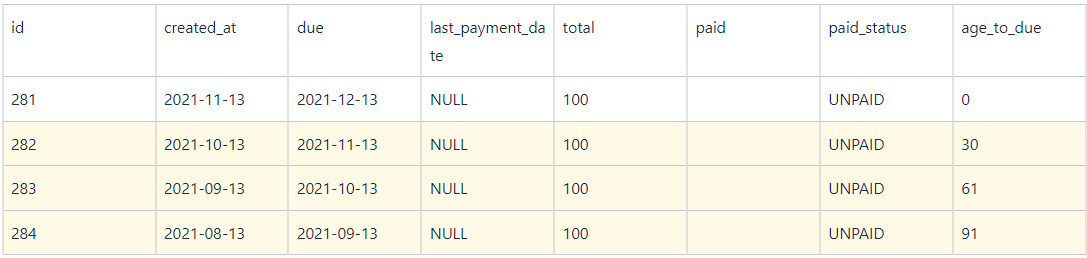

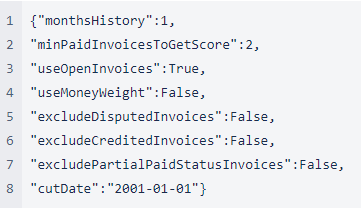

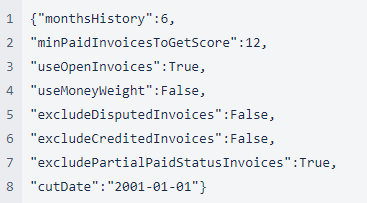

Settings

Invoices

Case 3

Similar to Case 1. But in the current case, avg age_to_due of the last 2 paid invoices is 2. As a result, unpaid invoices with current age_to_due=0 (<2) should not be used for score calculation.

Score 91.83

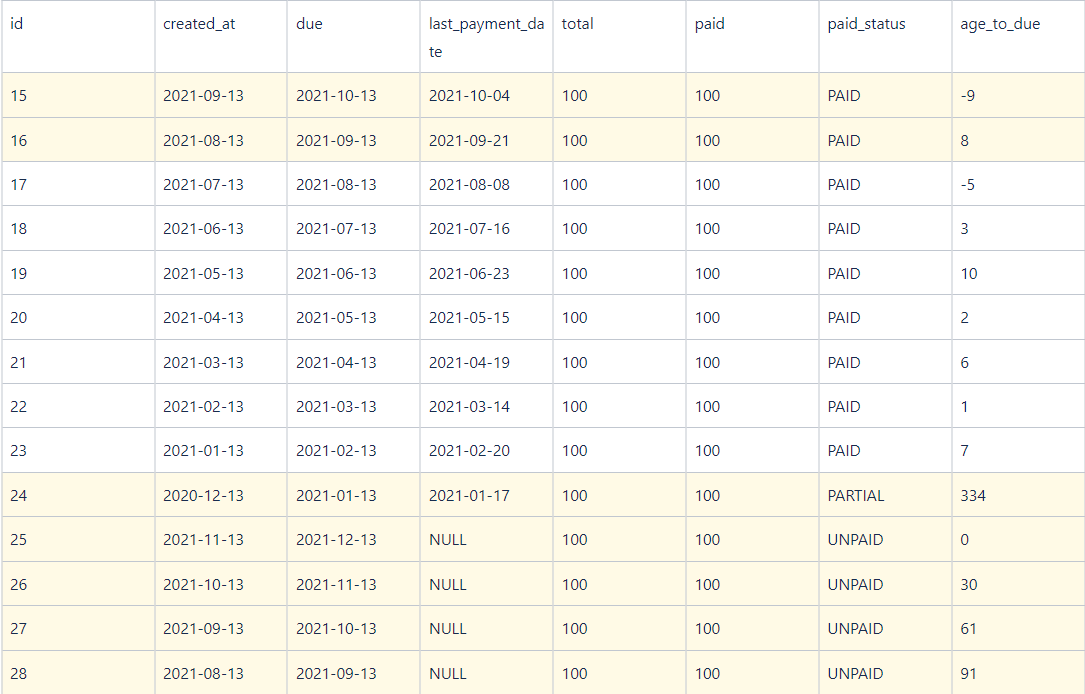

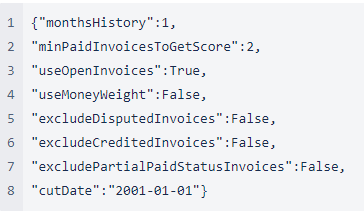

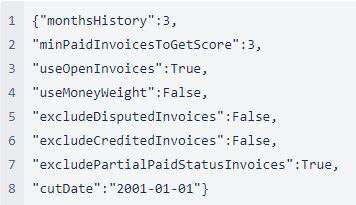

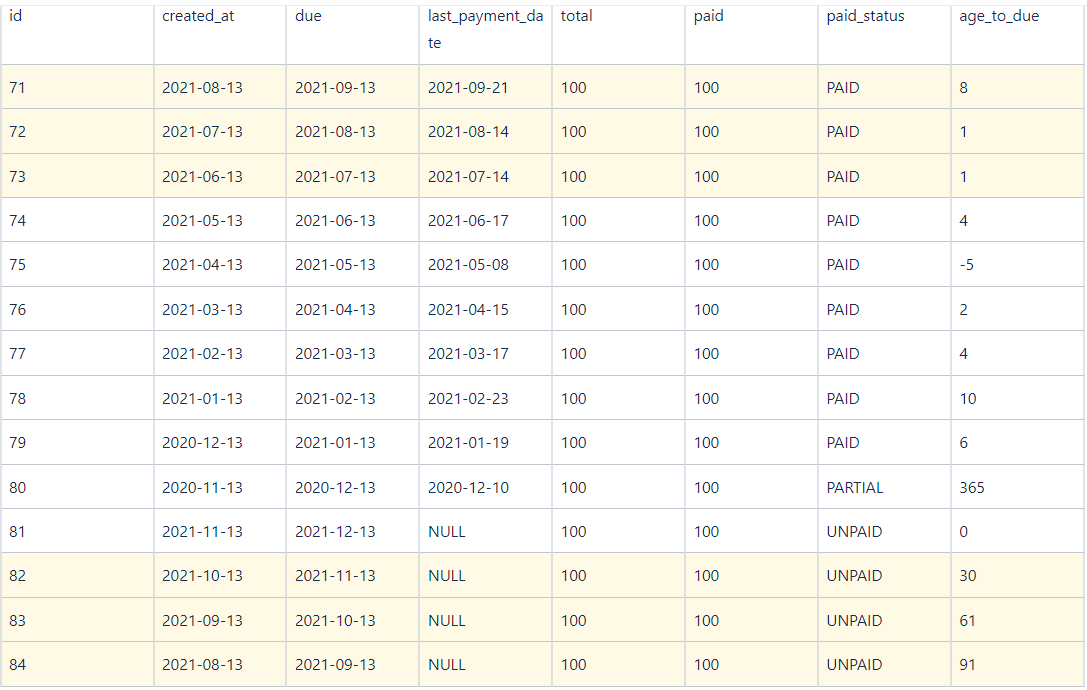

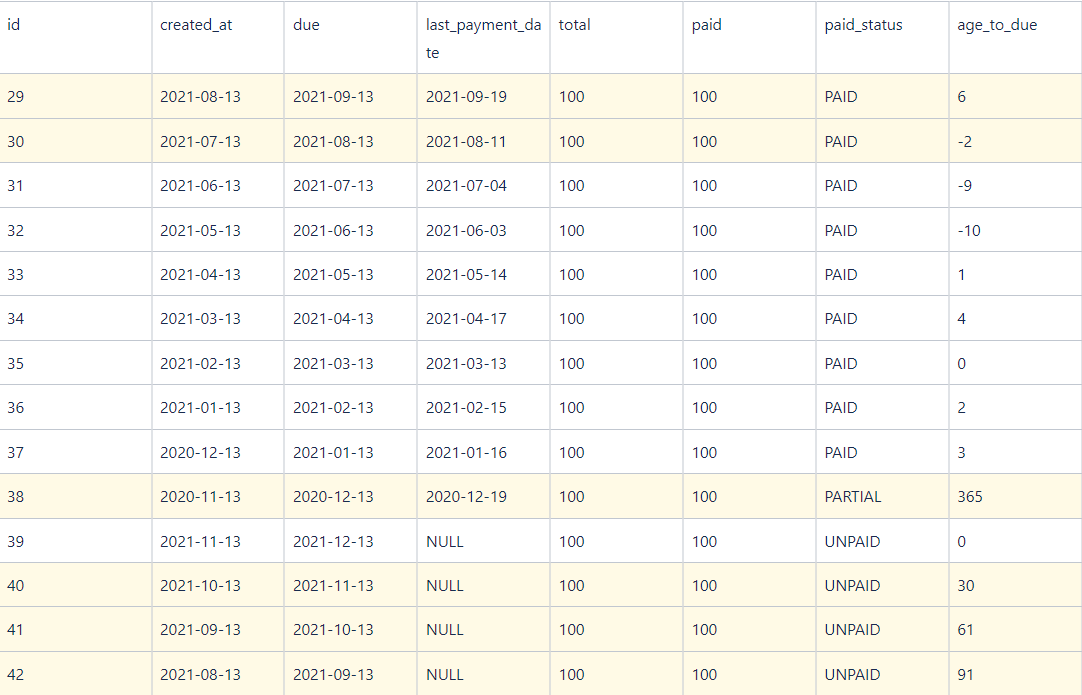

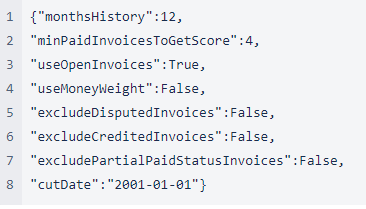

Settings

Invoices

Case 5

3 last paid invoices are used for the score as minPaidInvoicesToGetScore=3. Their avg age_to_due is 4.3 thus unpaid invoice with age_to_due=0 is excluded from the score.

Since excludePartialPaidStatusInvoices=True, an invoice with id=66 which is partially paid is also excluded from score calculation.

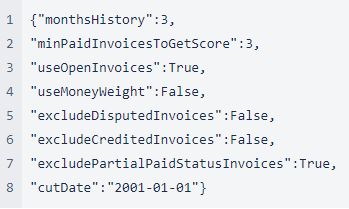

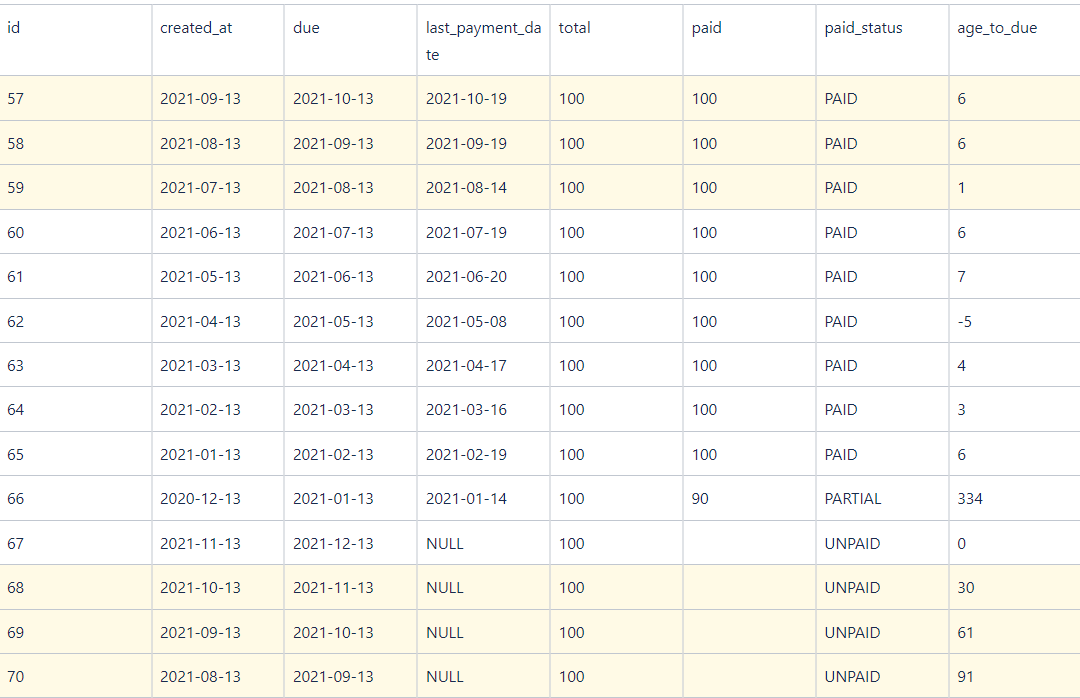

Score 32.5

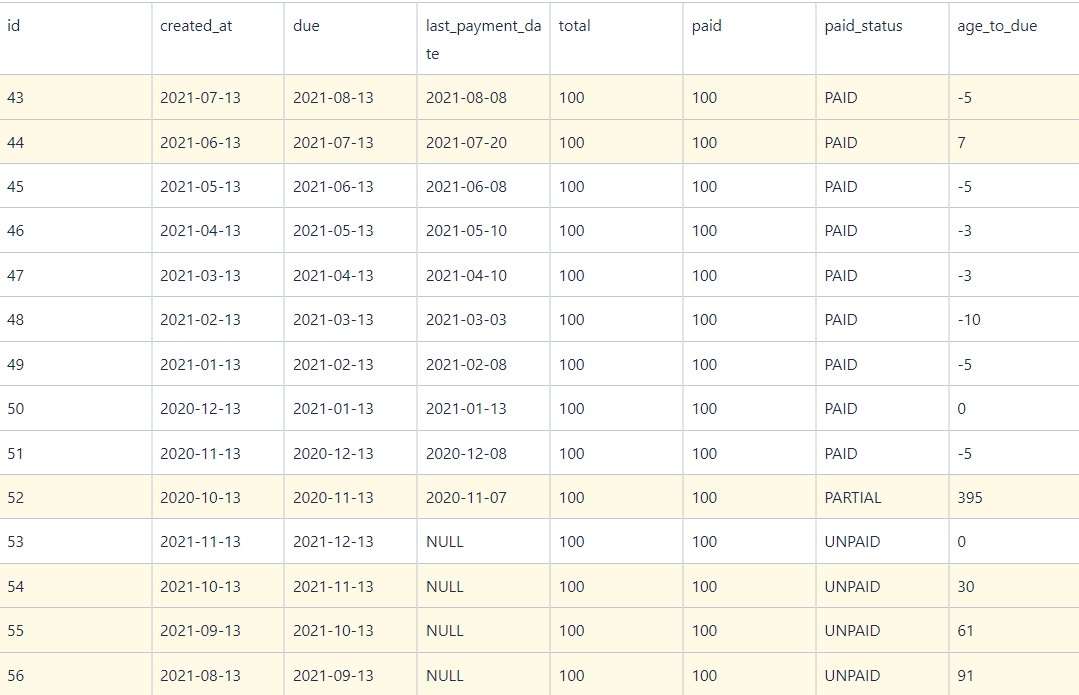

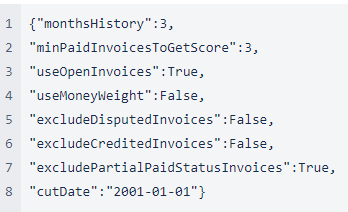

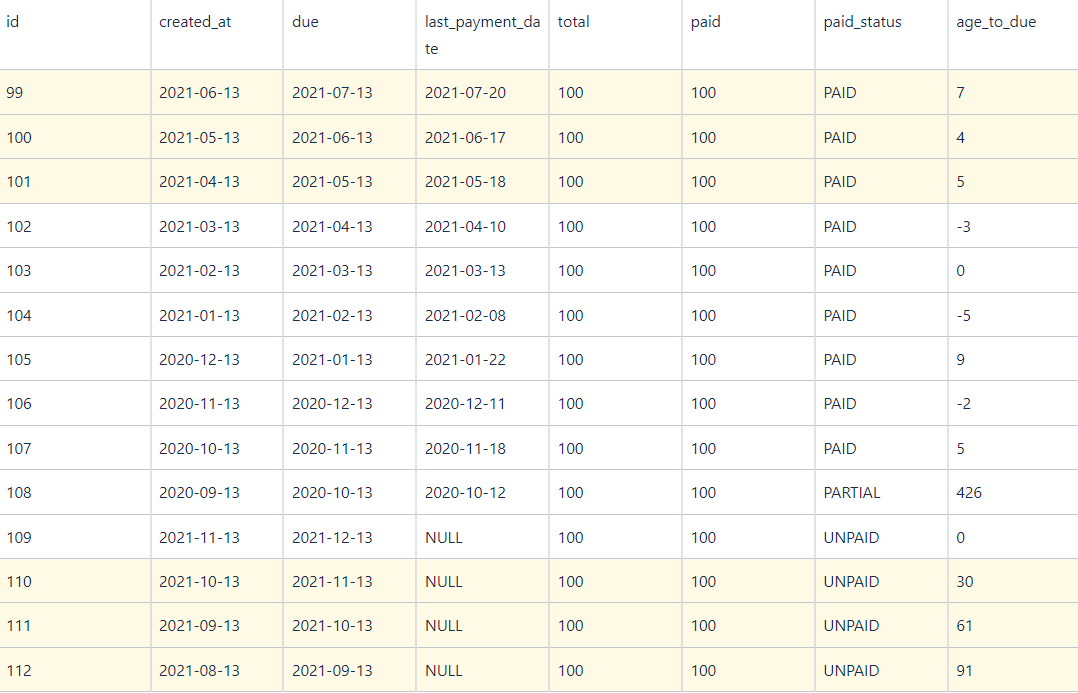

Settings

Invoices

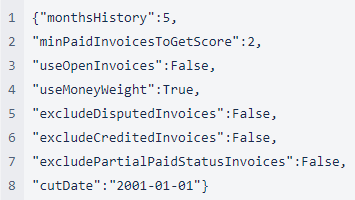

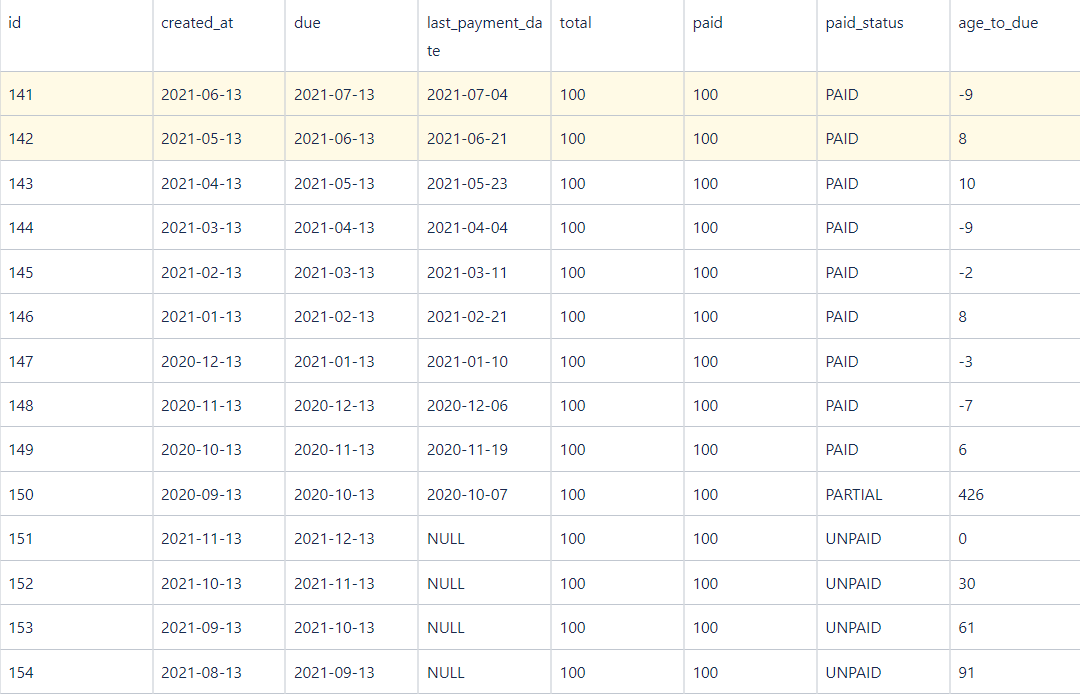

Case 9

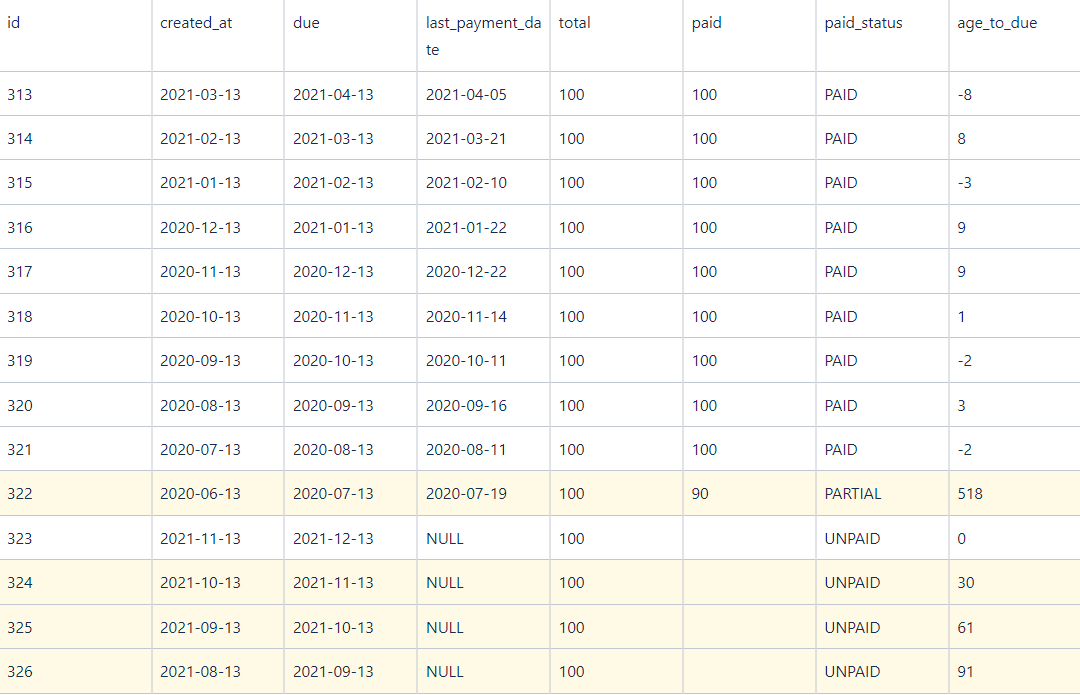

There are 3 paid invoices over monthsHistory=5 which are all taken for a score.

Unpaid invoices are not used for a score since useOpenInvoices=False

Score 4.0

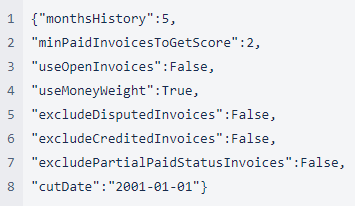

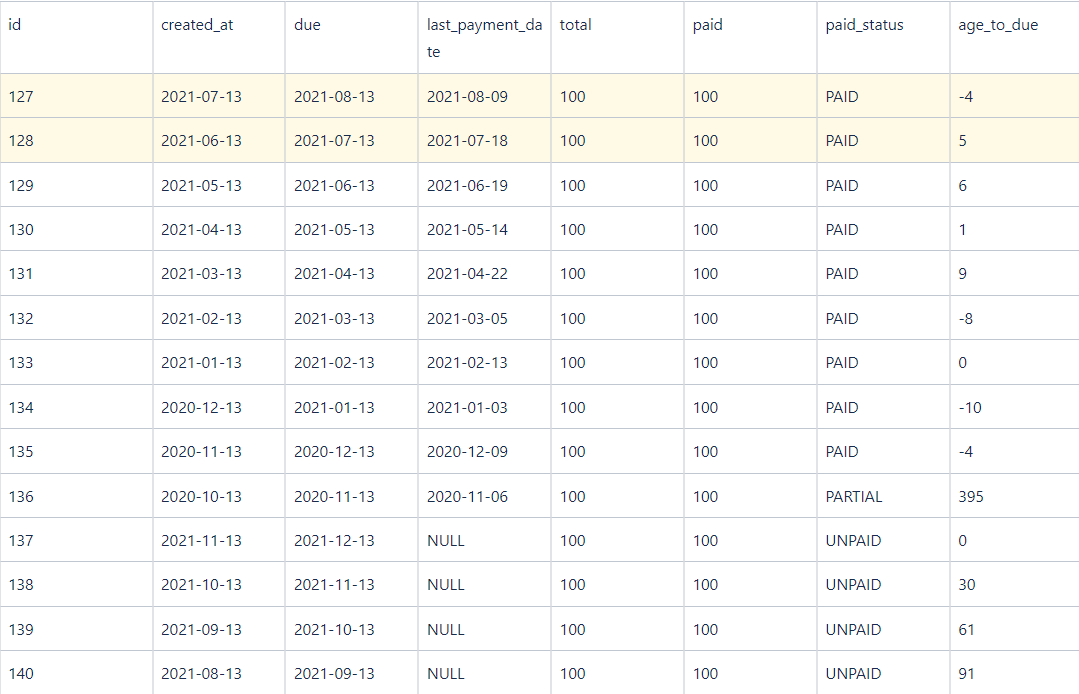

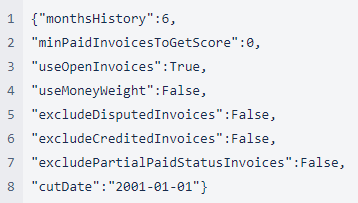

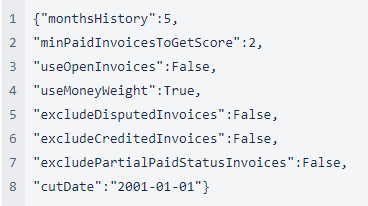

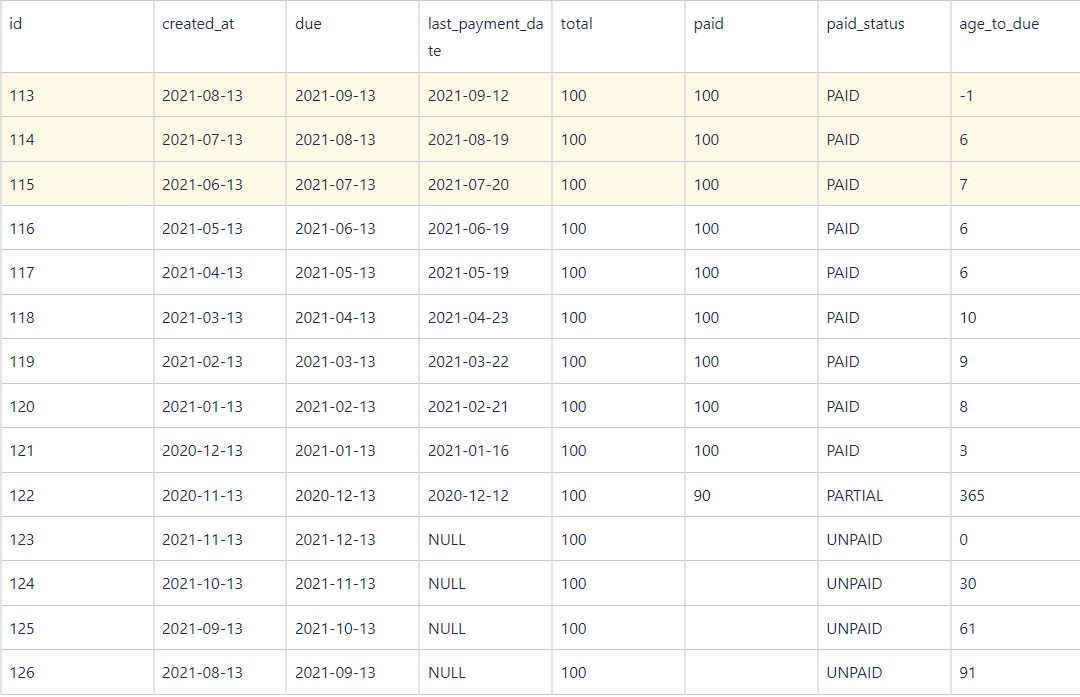

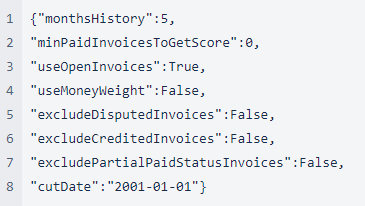

Settings

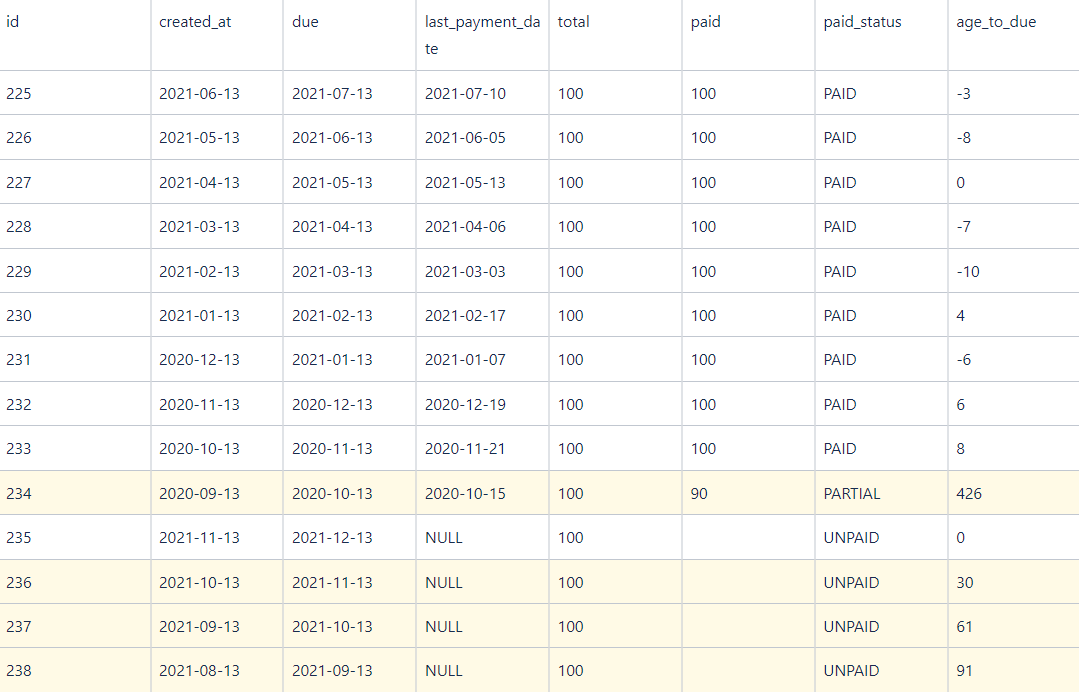

Invoices

Case 13

Taken all paid invoices since they fall into monthsHistory period.

Taken all unpaid invoices since all have age_to_due greater than avg age_to_due of paid invoices.

Score 36.64

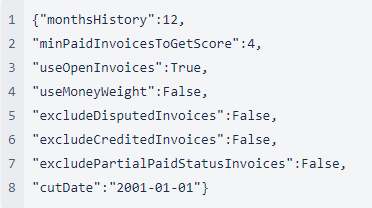

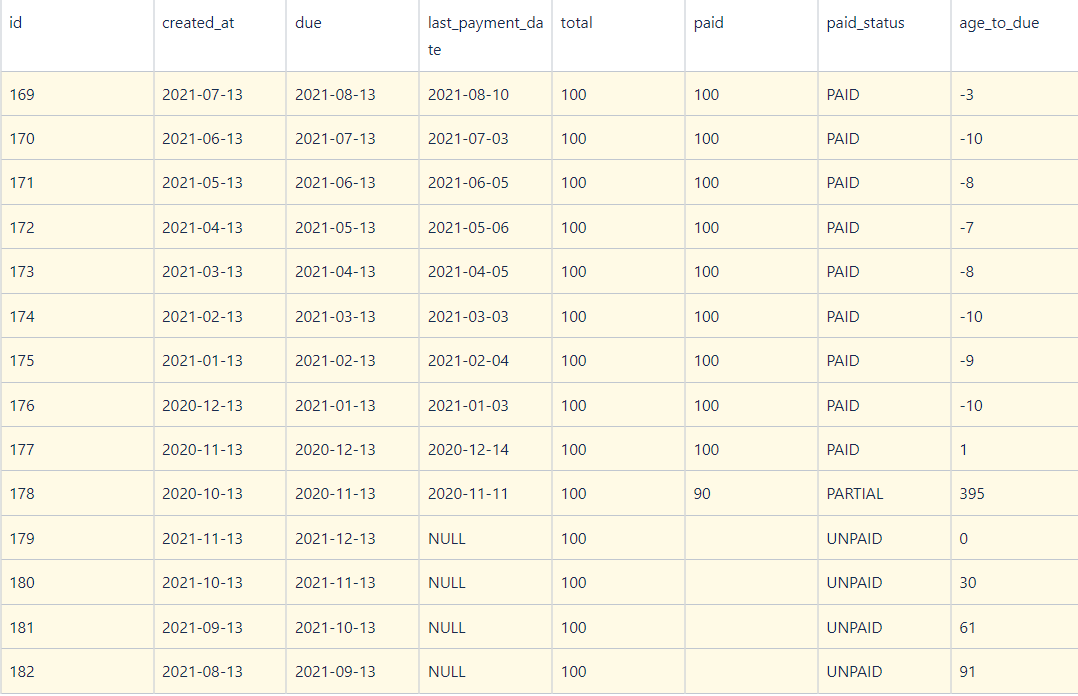

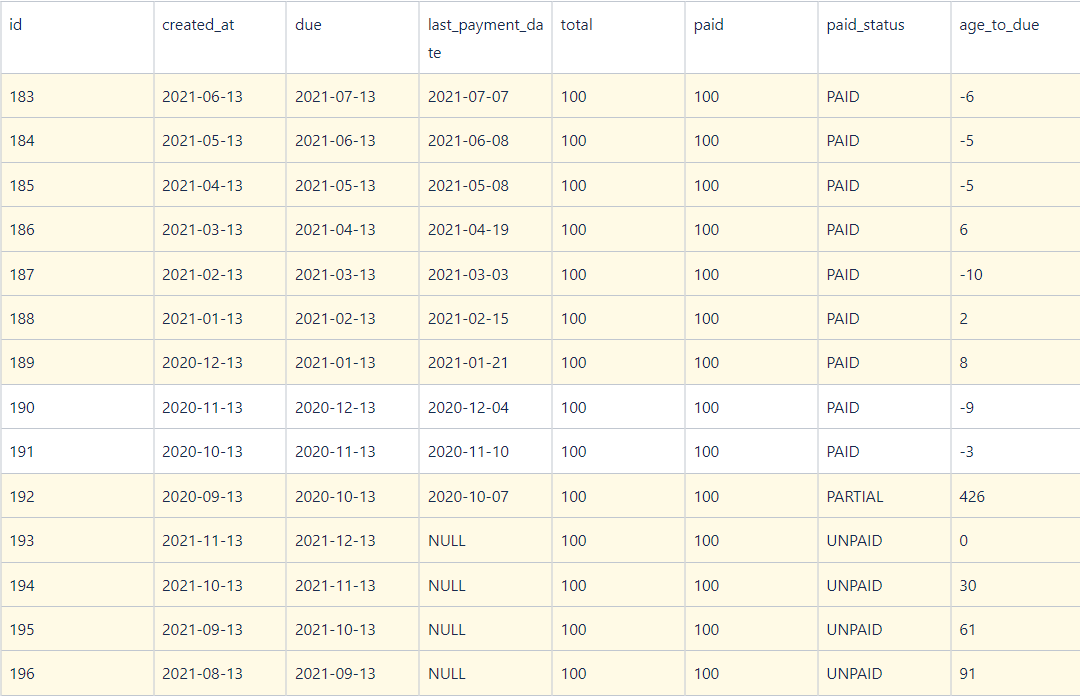

Settings

Invoices

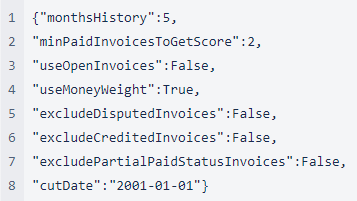

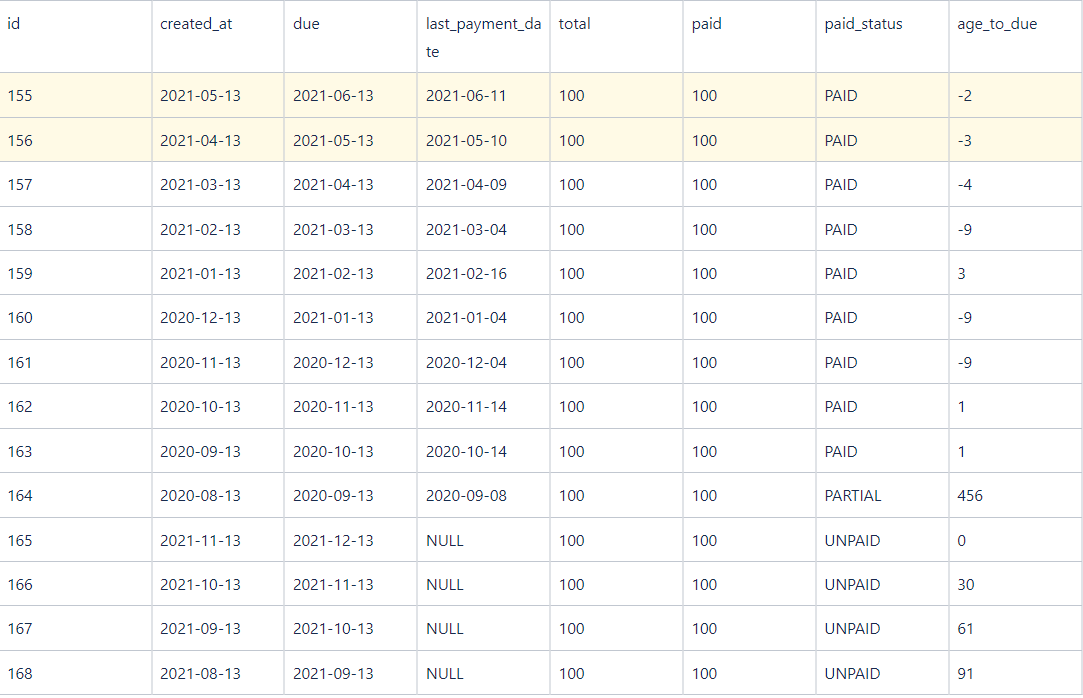

Case 14

Only 7 paid invoices fall into monthsHistory and are taken for score calculation.

All unpaid invoices are used for calculation since all have age_to_due greater than avg age_to_due of paid invoices.

Score 49.83

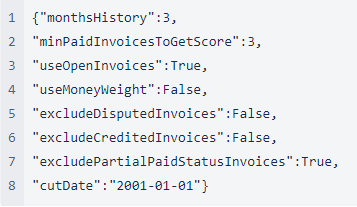

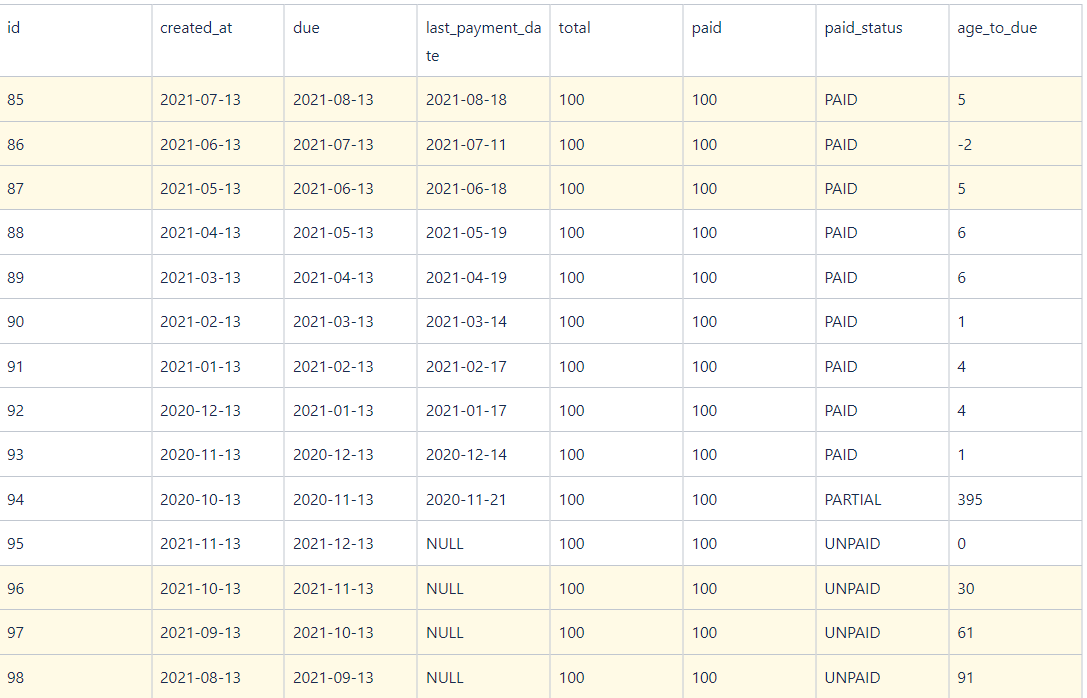

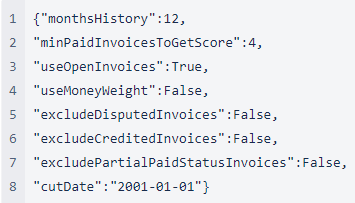

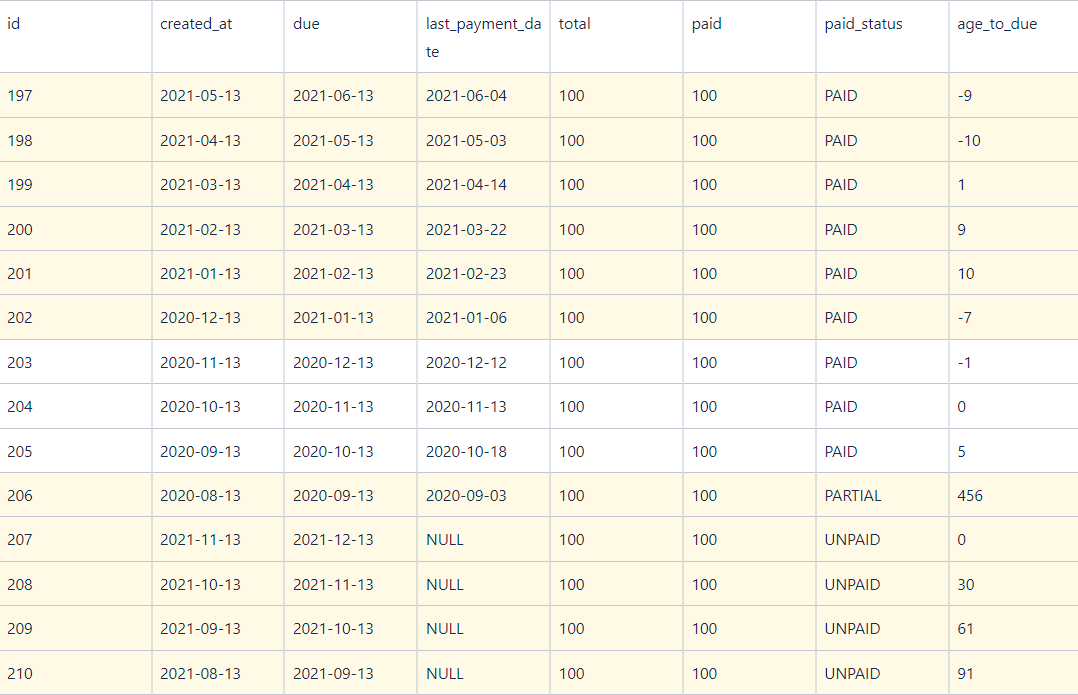

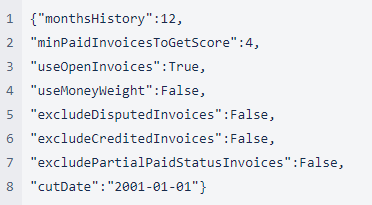

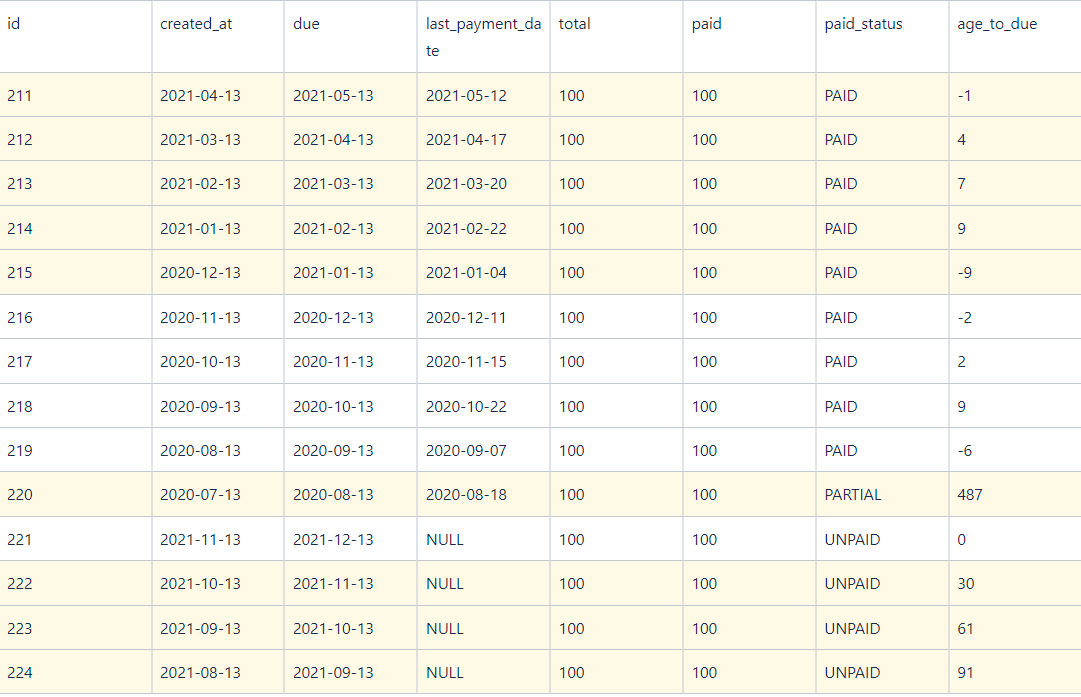

Settings

Invoices

Case 16

Similar to Case 14. The difference is that avg age_to_due of paid invoices is 2 and the unpaid invoice with age_to_due=0 (<2) is not used for score calculation.

Score 75.44

Settings

Invoices

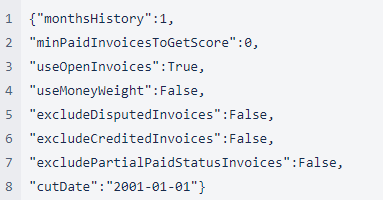

Case 17

There are no paid invoices over monthsHistory. Since minPaidInvoicesToGetScore=0 we don't look for longer monthsHistory to find paid invoices.

Open invoices with age_to_due>0 (0 is a default score) are taken for score calculation.

Score 152.0

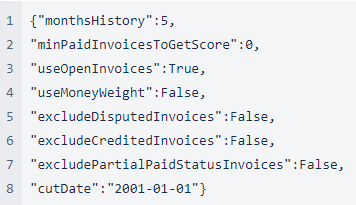

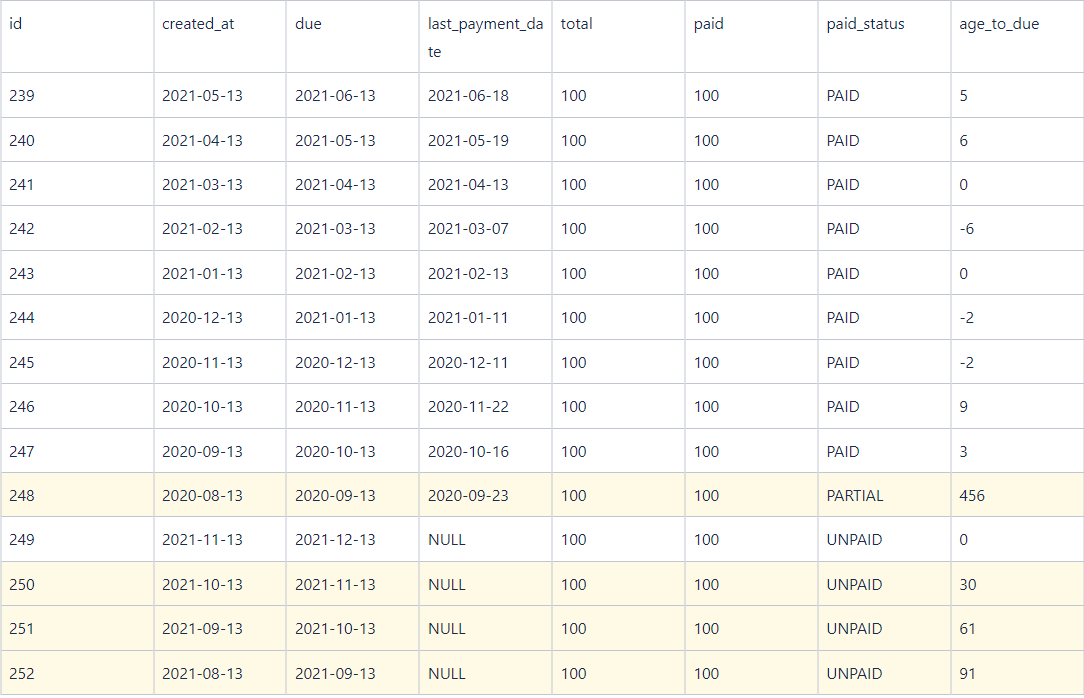

Settings

Invoices

Case 19

Since minPaidInvoicesToGetScore=1 we require at least one paid invoice to calc a score. As there are no paid invoices score is NA.

Score NA

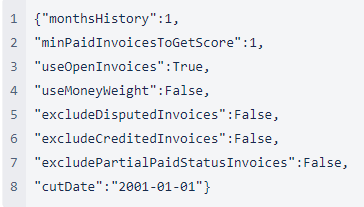

Settings

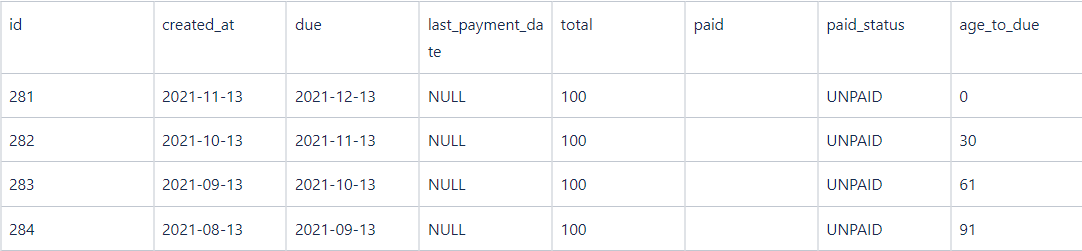

Invoices

Case 21

Since minPaidInvoicesToGetScore=12 we require at least 12 paid invoices to calc a score. As there are only 9 paid invoices score is NA.

Score NA

Settings

Invoices

Case 22

There are no paid invoices for the customer. Since minPaidInvoicesToGetScore=0 we don't require paid invoices to calculate the score.

All open invoices with age_to_due>0 (default value) are used for score calculation.

Score 60.67

Settings

Invoices