Activating the Credit Page

To activate the Credit page, contact YayPay Support (support@yaypay.com) or your YayPay Account Rep.

Once activated, you will have access to the following features. However, their availability is further influenced by the specific configuration in the Settings | Business page:

- By checking the [ADMIN] Enable Advanced Credit check box, you will be able to see the following settings in Settings | Business:

Use YayPay as the system of record for Credit Limits – all the changes made inside YayPay are saved and records are not pulled from ERP with any new sync. Additionally, credit limit becomes editable in the header of the Statement page.

Enable Online Credit Application

- By checking both the [ADMIN] Enable Advanced Credit and Enable Online Credit Applicationcheck boxes, the following features will become available, allowing you to:

- Use the functionality on the separate Credit page, for example:

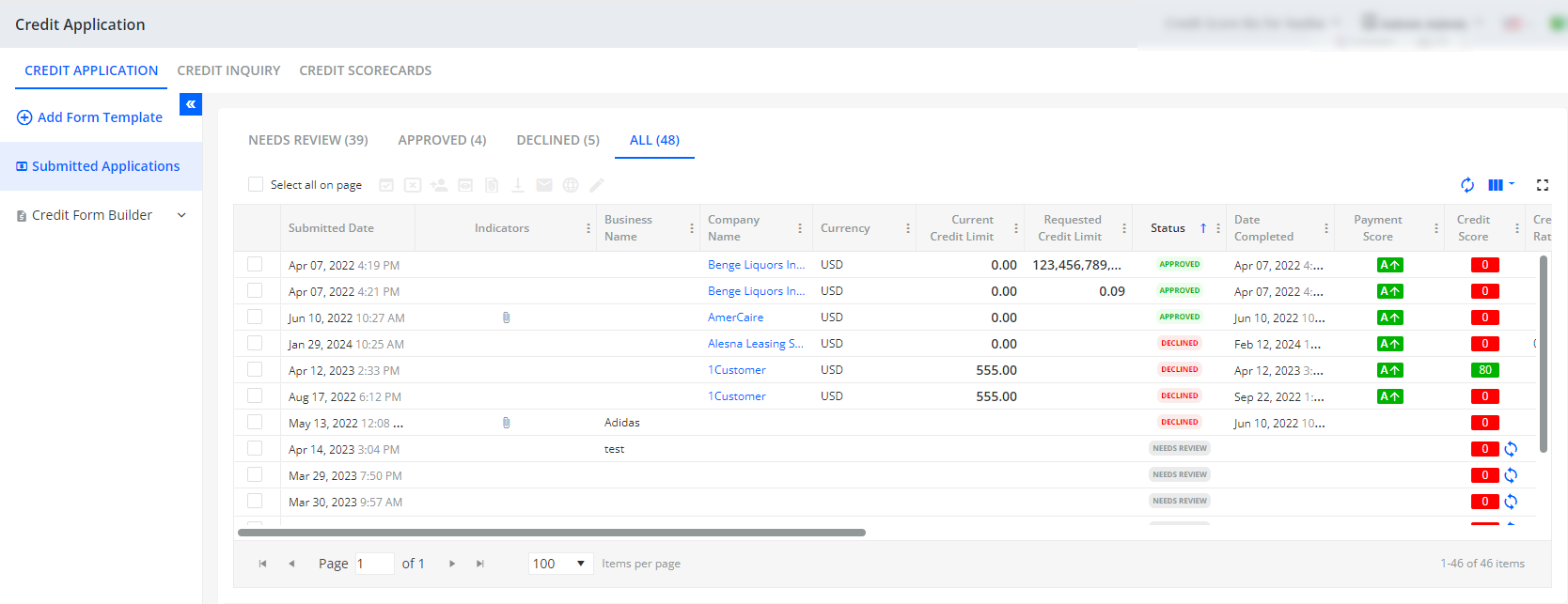

Manage credit applications in the CREDIT APPLICATION section.

Create credit applications using Credit Form Builder in the CREDIT APPLICATION section.

Use credit scorecards in the CREDIT SCORECARDS section.

Inquire business creditworthiness in the CREDIT INQUIRY section (provided that [ADMIN] Turn on Credit Inquiry is checked).

Edit credit rates and IDs in the Manage Rates dialog (opened via Edit in the header of the Statement page).

Access the CREDIT APPLICATIONS and CREDIT SCORE LOG tabs on the Statement page.

Use the Credit Application - Credit Application received and Customer - Credit Score has changed by X points workflow events.

Use the Update external credit data workflow action.

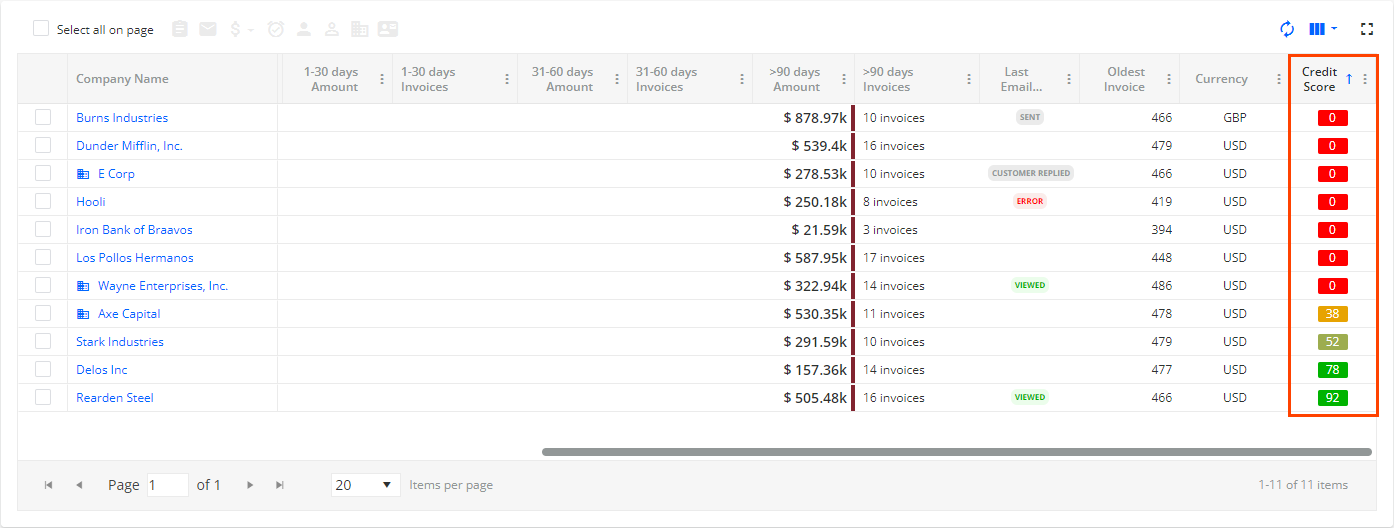

Add Credit Score column on the Invoices pages

Use the {CreditApplicationBusinessName} and {CreditAppTemplateLink.[Name]} dynamic tags.

- Use the functionality on the separate Credit page, for example:

If you do not have the advanced credit functionality activated, you will still have access to a basic set of credit-related features. For more details, see the Credits section.

Credit Page Overview

The Credit Application page serves for managing credits in one place. It includes the CREDIT APPLICATION, CREDIT INQUIRY and CREDIT SCORECARDS sections.

For more details about the individual sections, see the following links:

-

CREDIT APPLICATION section:

Use the Submitted Applications tab to track, review, and manage sent credit application forms.

Use the Credit Form Builder to simplify the process of requesting credit applications.

You can use the credit application form as it is, or customize it by adding or removing elements.

-

CREDIT INQUIRY section:

Use the Credit Inquiry to request information related to business creditworthiness, i.e. the financial health and reliability of a business

-

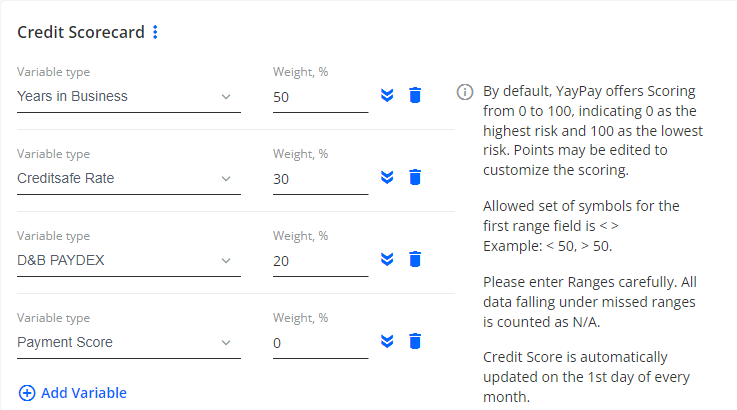

CREDIT SCORECARDS section:

Use the Credit Scorecards to score your customers using different variables depending on your business needs.

As a result, you can see the company's Credit Score at places such as the customer's Statement page or Aging Report page. For example: