Welcome to the latest version of our software! We have decided to rename our Release Notes to What Is New to better communicate the updates and improvements we have made.

In this document, you will find a summary of the most significant new features, enhancements, and changes we have made to the software. We hope this new format will help you better understand the new features and functionality we have added.

General Features

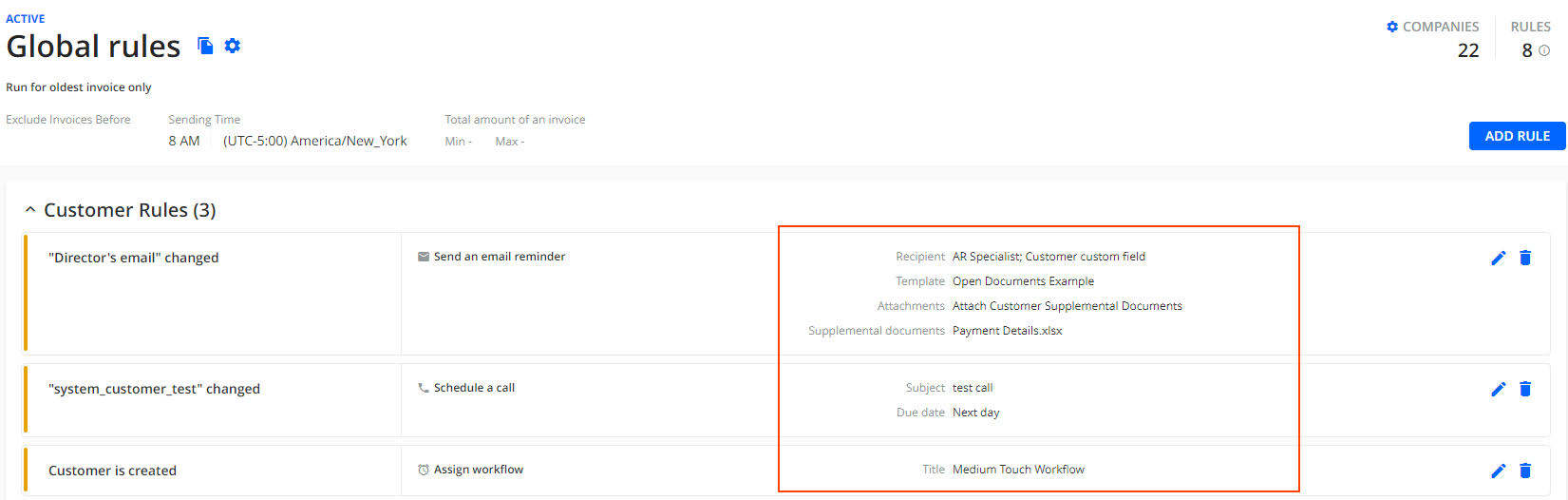

Additional Details in Workflows

We have enhanced the Collection Workflows and Global Rules tabs on the Workflows page to show more information, such as due dates, payment methods, notes, attachments, names of AR specialists, CS specialists, and more.

With this improvement, you will have a more comprehensive view of the established rules and actions.

For more information see, the Collection Workflows & Rules Engine article.

Usability Improvements

To improve your user experience when using YayPay, we have made numerous enhancements, including:

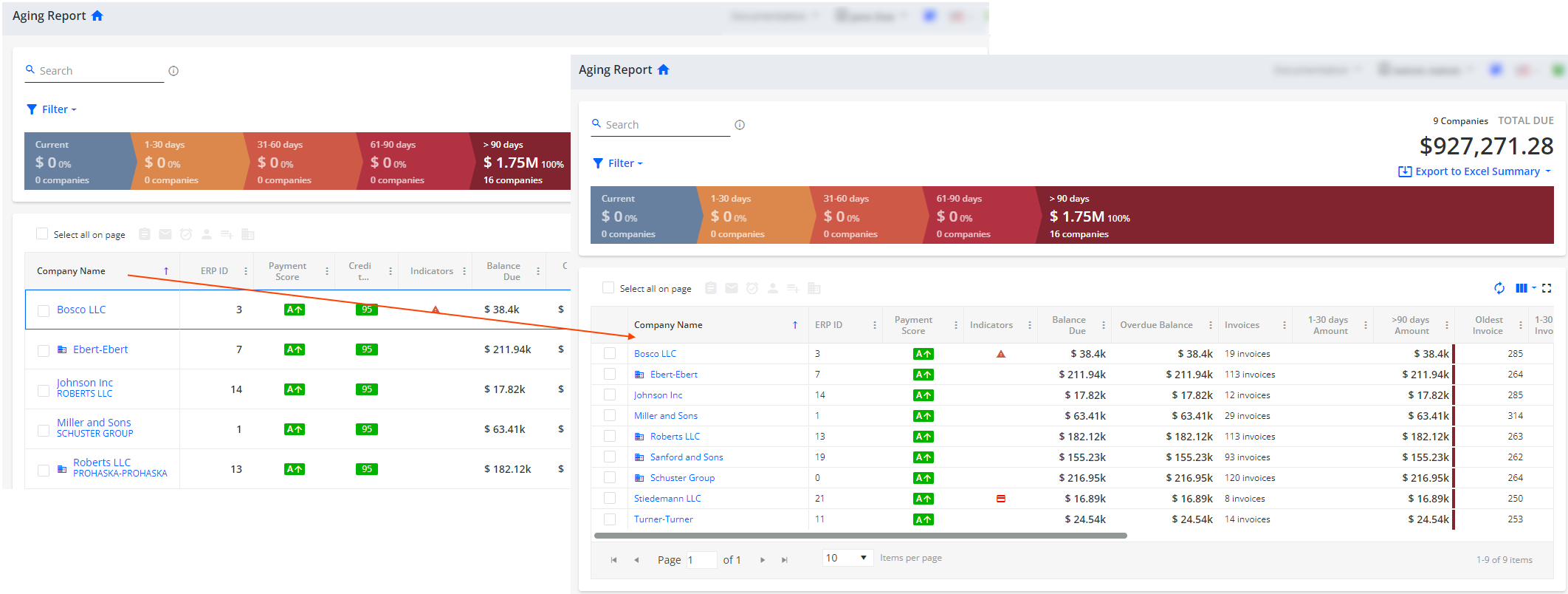

- Changing the size of grids and tables for an easier overview and better navigation.

Allowing you to reorder and resize columns as needed.

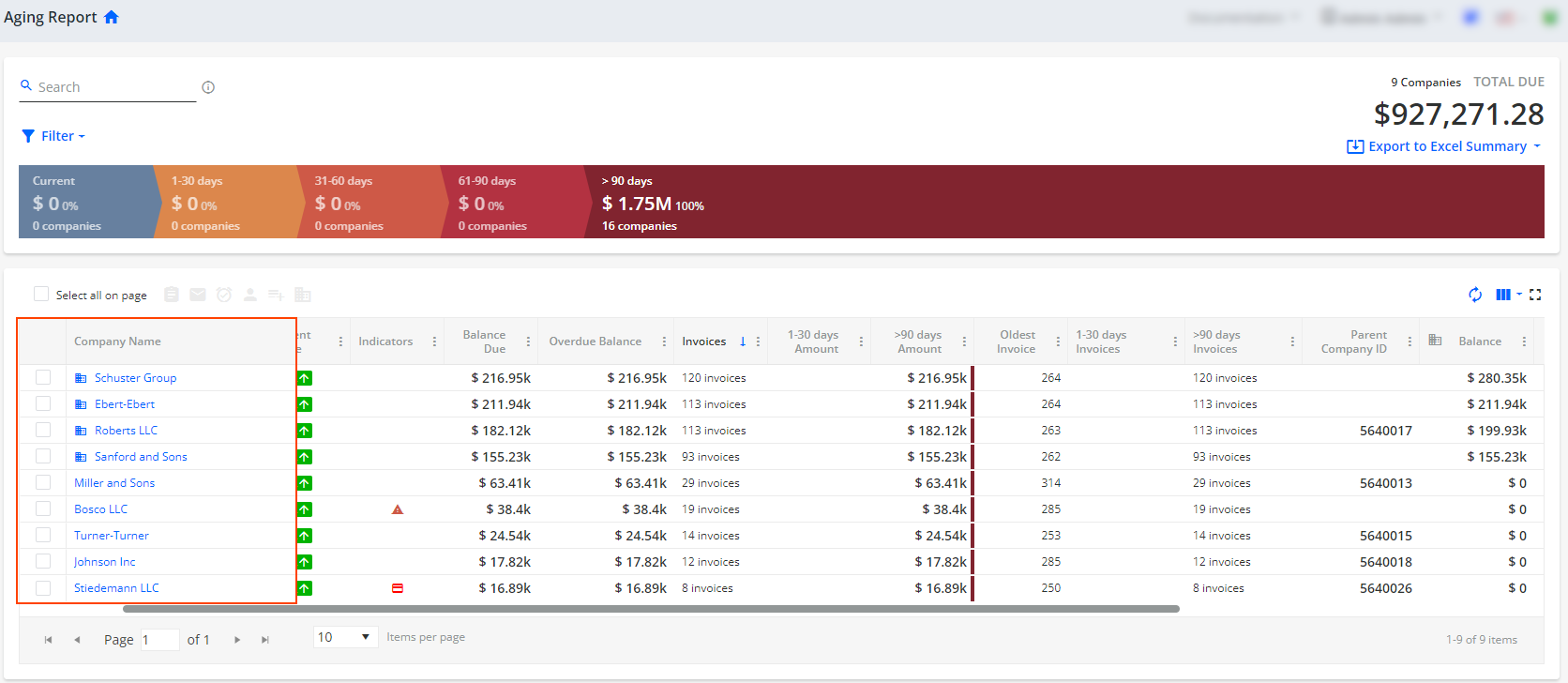

- Freezing the first column on grids to improve the orientation and easily identify related data while scrolling. For example, on the Aging Report or Invoices pages.

Updating columns on the Aging Report page's grid to better reflect their purpose, making it easier to understand and use.

Additionally, the Credit Limit column now displays credit limit amounts in the 000.0N format, where N is the abbreviation for the amount, such as "k" for thousands. For example, a credit limit of $691.21k means the limit is $691,210.Adding more indicators to the Indicators column on the Aging Report and Statement pages.

Adding the Indicators column to the Open Credits tab on the Statement page.

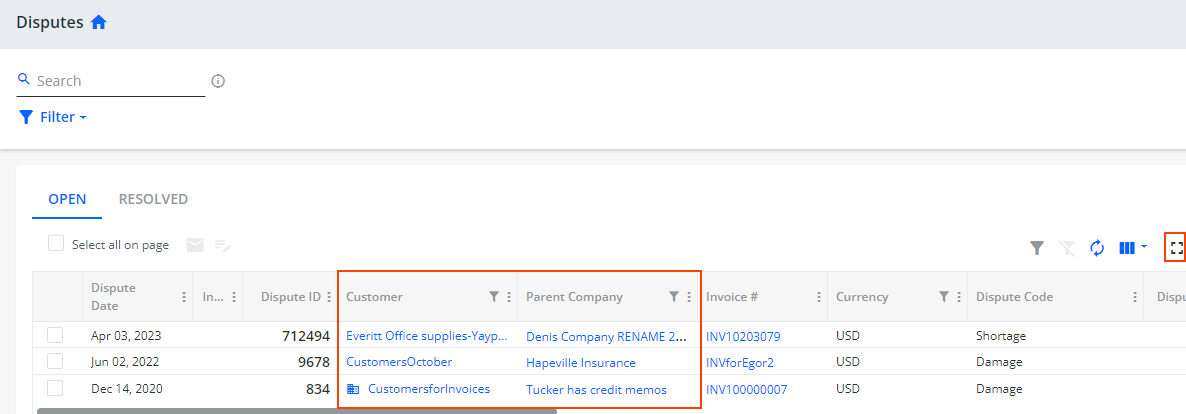

Renaming the Company Name column to Customer on the Disputes and To-Do pages.

- Adding a Parent Company column on the To-Do and Disputes pages.

You can sort and filter data in both Customer and Parent Company columns. Adding the Expand Grid icon on multiple pages. For example, on the Aging Report and Disputes pages, the SALES ORDERS tab on the Statement page, and on the Credit page. Clicking on the icon opens an extended view of the grid for easier customization such as changing the column order or size.

Updating the SALES ORDERS tab on the Statement page to include the Customer name and Parent Company columns. These columns will become visible in the column picker, if you check the Parent level collections on the Statement page.

Cash Application

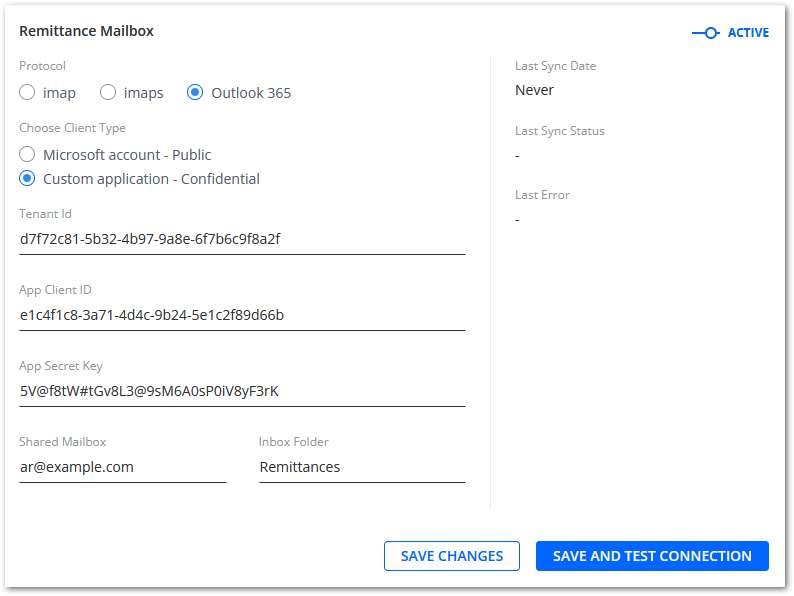

Confidential Client Apps Supported for Outlook 365 Mailboxes

You can now use a confidential (Azure Active Directory) client application to authorize YayPay to integrate with an Outlook 365 mailbox.

Confidential client applications provide an additional layer of security by allowing users to authenticate using client credentials instead of user credentials. This means that users do not have to share their Microsoft login credentials with YayPay, reducing the risk of unauthorized access to their account.

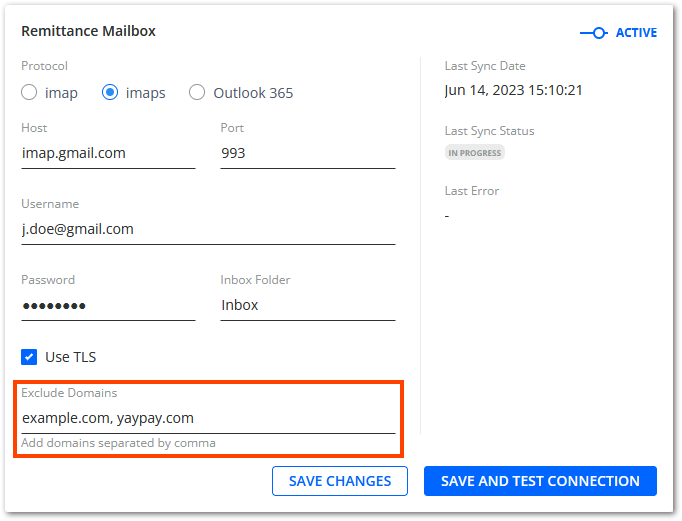

Domain Exclusion Added to Remittance Mailboxes

When integrating the Cash Application module with a custom remittance mailbox, you can now configure excluded domains. YayPay will ignore any email delivered to the given mailbox from the excluded domains.

By filtering out spam or irrelevant emails, you can ensure that the remittance records created in the Cash Application module are based on valid and relevant payment information. This will help to reduce errors in the payment allocation process and improve the overall efficiency of the accounts receivable process.

Identifying Customers of Remittance Emails Enhanced

We have greatly extended YayPay's ability to identify the customer who sent an email to your remittance mailbox.

Previously, YayPay was able to match the sender's email address against the customer billing contacts available in YayPay.

Now, YayPay also matches email addresses against regular customer contacts available in YayPay. Additionally, it applies new rules to identify the customer, utilizing the following email properties:

- Sender's email address

- Any email addresses found in the body of the email

- The sender's email address domain

To learn how the new rules work, see the Identifying Customers Who Sent Remittance Emails section of the Cash Application Settings article.

Remittance Allocation Process Enhanced

The following features are now available for remittances created based on the Auto-Pay and Pay on Account YayPay payment types:

Previously, users could only view remittances created based on the listed payments types.

The ability to allocate all remittances to invoices improves accuracy and reduces errors in the payment allocation process, providing users with a clearer view of their accounts receivable, making it easier to reconcile payments and invoices.

Support of CSV Payment Files Enhanced

We have made it easier to upload CSV payment files into YayPay.

Our platform can now process files that include payment amounts formatted with commas (e.g. 12,345,678.90). You no longer need to remove commas manually before uploading.

Handling Payment Pushing Errors Enhanced

When you encounter an error with a payment pushed to your ERP system, you can fix the error and push the payment to your ERP again.

To indicate that the error has been fixed, YayPay now changes the payment's Sync Status from ERROR to NOT SYNCED. YayPay considers the error fixed if you make changes to at least one of the following payment parameters:

- Customer

- Bank account

- Payment amount

- Payment type

- Associated remittance

- Payment allocation (in any way)

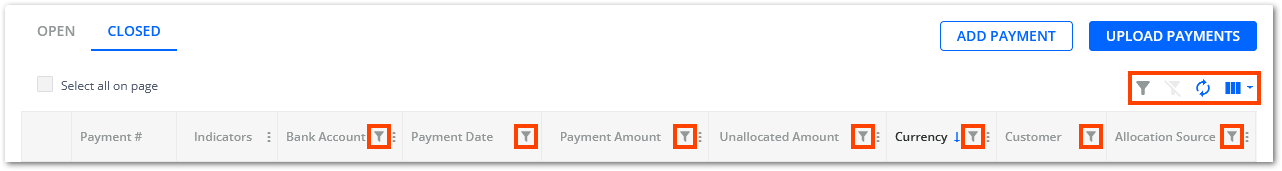

Closed Payments Grid Enhanced

We have implemented several new features to improve the closed payments grid, making its features consistent with the open payments grid. You can now:

- Select which columns to display using the Select Columns icon.

- Reset the grid to its default state using the Reset Columns to Default icon.

- Filter the grid's data using the Filter icon which is available for a number of columns.

- View which filters are currently applied using the Grid Filters Applied icon.

- Clear all applied filters using the Clear Filters icon.

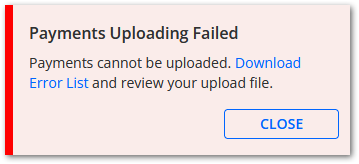

Payment File Error Handling Improved

We have improved the user experience of handling errors in payment files uploaded into the Cash Application module.

If there is an error in every payment record in the uploaded file, YayPay now notifies you with a new warning dialog, allowing you to download an Excel sheet with all the error details.

Payment-Remittance Association Enhanced

We have improved the Manage Remittance Link dialog, which is available for payments that have been linked to a remittance.

Now, using the Manage Remittance Link dialog also affects the given payment's allocation:

- If you remove a remittance link, the existing payment allocation is removed.

- If you change a remittance link, the existing payment allocation is removed, and a new allocation (if available) is created based on the selected remittance.

This new feature makes the payment allocation process more accurate and transparent, ensuring payment allocations are always based on the most up-to-date information. That reduces the risk of errors or discrepancies in the accounts receivable records.

Credit

CoFace Credit Inquiry Provider

To help you make better informed decisions, you can now connect to a new credit inquiry provider called CoFace. CoFace is a European provider that can search and asses creditworthiness of companies around the world.

Before performing a credit inquiry search, you must create an account with this provider. After that, navigate to Settings| Payments/Credits to configure its settings.

For more details, read the How to Connect YaPay to Credit Inquiry Providers article.

Reporting

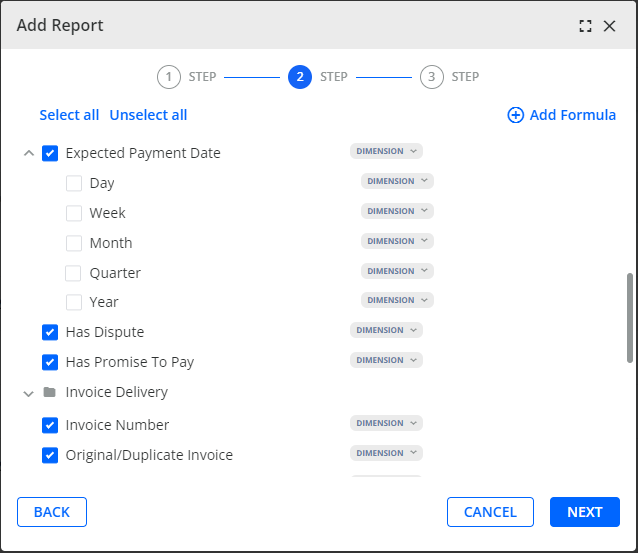

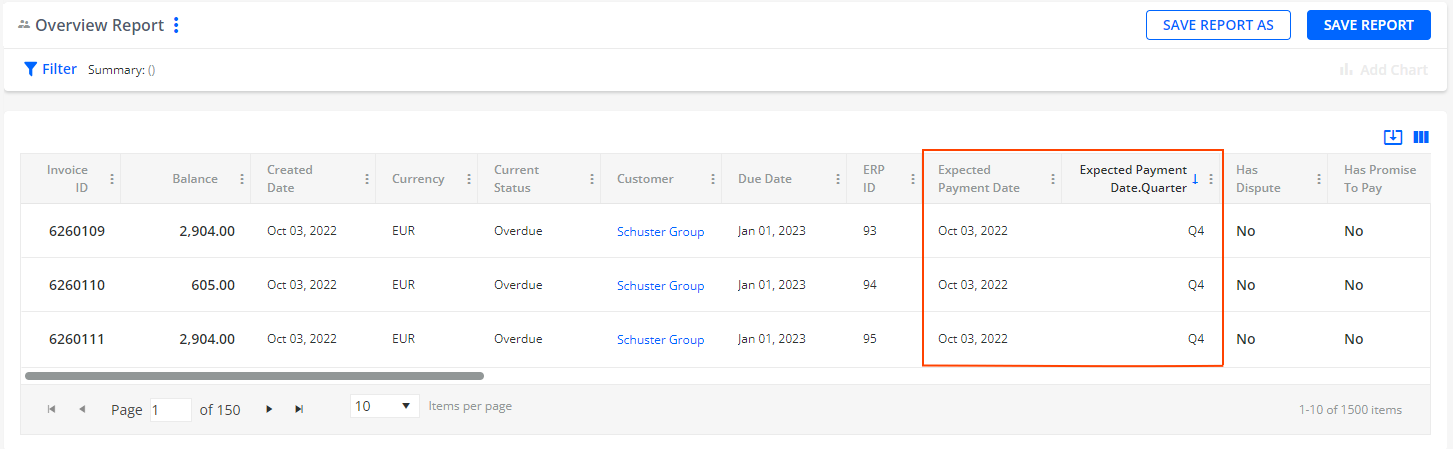

Expected Payment Date Column Added to Invoice Data Source

Gain greater control over your finances by utilizing the Expected Payment Date column in your reports. Knowing the expected payment date can help you to better plan and manage your finances, including paying bills and expenses, making investments, and more.

You can now include the Expected Payment Date column, along with its nested Day, Week, Month, Quarter, and Year elements in reports created with the Invoice Data Source.

After creating a report containing a Expected Payment Date column, you can add the column to dashboards, charts, use it in formulas and its filters, or export the report containing the column as an Excel file.

In reports, the column can be sorted and filtered. However, see the Determining Expected Payment Date section to learn how the values are calculated and updated. If the calculation is based on the Average Payment Time (APT), it will only be recalculated and updated once a day, unlike other columns in your reports that update whenever you display or refresh them.

For more details, read the Reporting Section Sources article.

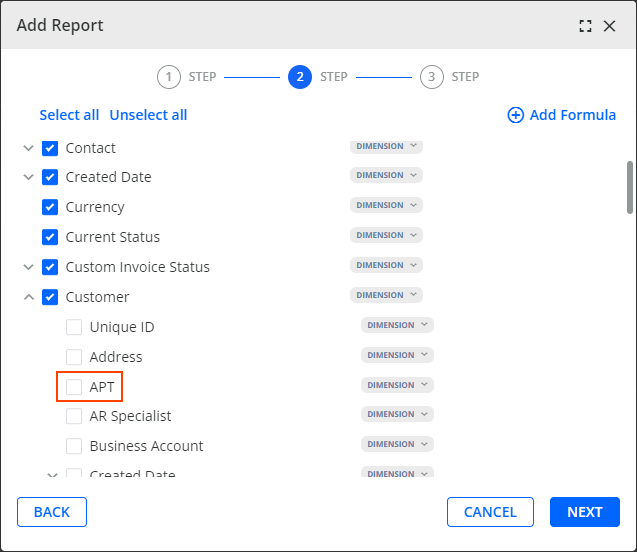

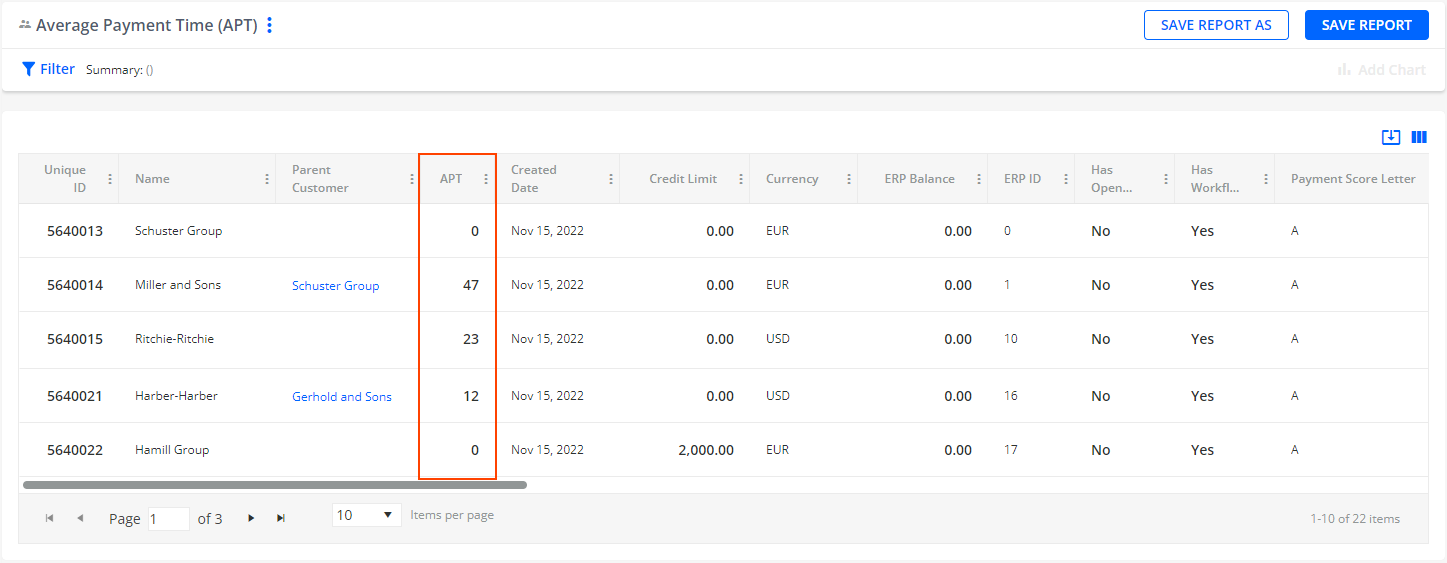

Average Payment Time Added to Invoice and Customer Data Sources

Improve your financial planning and cash flow management by tracking the time it takes for your customers or clients to pay their invoices, thus you can make more informed decisions about when to expect payment and allocate resources accordingly.

You can now include the Average Payment Time APT column in your reports created with the Invoice or Customer Data Source.

You can add the column to dashboards, charts, use it in formulas and its filters, or export it to Excel.

Once you add the column to a report, its values can be sorted and filtered. However, its value will be recalculated and updated once a day only, unlike other columns in your reports that update whenever you display or refresh them.

For more details, read the Reporting Section Sources article.

*Release Date: August 19, 2023*