This document provides a summary of the most significant new features, enhancements, and changes we have made to the software. For further details regarding Localization, Supported Software or Recommended Limits, review the Accounts Receivable by YayPay Release Notes.

Cash Application Features

Auto-Allocation of Payments Enhanced

We have made significant enhancements to how YayPay auto-allocates payments based on information extracted from remittance emails.

YayPay now has the capability to extract specific amounts that are intended for allocation to particular invoices from those emails. When such information is available, it's given priority in the auto-allocation process. This means that YayPay will allocate payments to the associated invoices based on these extracted amounts, thus further optimizing the process of auto-allocating payments using remittance-payment association.

The pre-existing auto-allocation process is still in place for invoices that do not have an allocation amount specified in the email. This ensures that all invoices, whether they have an associated allocation amount or not, are properly allocated.

You can find more details about the auto-allocation process in the Auto-Allocation Using Remittance-Payment Association section of the Payment Allocations article.

Auto-Allocation of Remittances Enhanced

We have enhanced YayPay's auto-allocation feature for email remittances. Now, it is even more efficient at handling emails containing valid invoice numbers and amounts, but lacking corresponding payment numbers.

With this enhancement, YayPay now auto-allocates such remittances exclusively to the invoices that are mentioned in the email with specific amounts intended for their allocation.

Additionally, YayPay now accounts for any available discounts. This means that if there are any discounts available, they will be factored into the remittance auto-allocation process, ensuring you get the most accurate and beneficial allocation possible.

Processing Payments Exported to CSV Enhanced

We have implemented several new features enhancing the process of exporting payments to CSV:

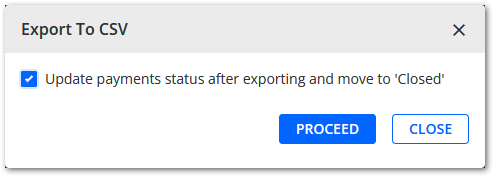

Move Exported Payments to the CLOSED Tab

You now have the option to move payments exported to CSV to the CLOSED tab, and changing their sync status to EXPORTED.

This enhances the organization of your payment data by separating successfully exported payments from those still being processed.

Note: This option is not available to businesses that integrate with Sage Intacct or Oracle Netsuite as the regular sync is available to them.

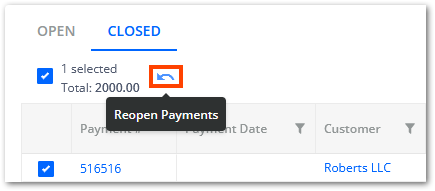

Reopen Exported Payments for Allocation Adjustments

You can reopen EXPORTED payments by selecting them and clicking on the Reopen Payments icon, allowing you to make allocation adjustments as needed.

Sync Status Updates

We have implemented the following sync status updates to incorporate exported payments, providing an audit trail for reconciliation:

- Payments exported to CSV will have their sync status changed to EXPORTED on the CLOSED tab.

- Reopened payments will be moved back to the OPEN tab and have their sync status changed to NOT SYNCED.

- Exported payments successfully synced via the CSV connector will have their sync status further changed to SYNCED.

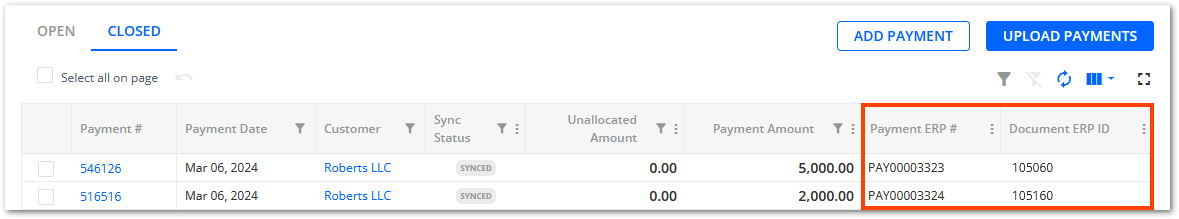

Tracing Synced Payments Enhanced

We have added two new (optional) columns into the CLOSED payments tab:

- Payment ERP # – Shows the number assigned to the given payment in the ERP.

- Document ERP ID – Shows the ID of the document that represents the given payment in the ERP.

The new columns become filled for SYNCED payments if the sync returns the corresponding data. This allows you to easily trace and cross-reference the payments in YayPay with their corresponding entries in your ERP system.

General Features

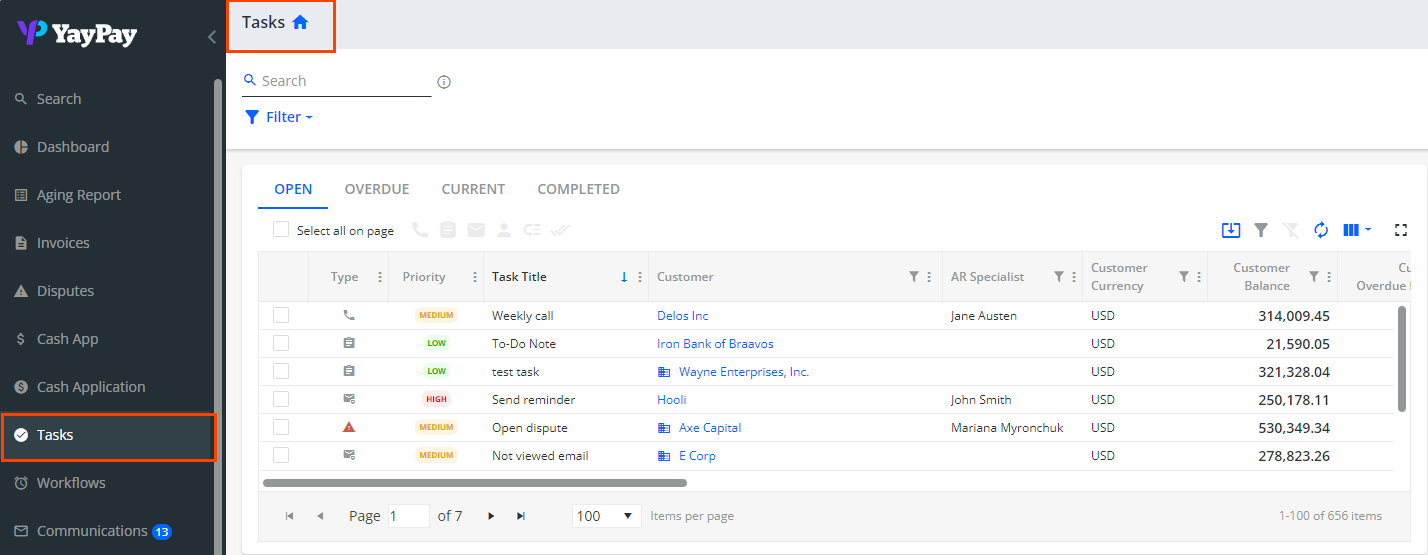

To-Do Page Renamed

We have renamed the To-Do page to Tasks.

Along with this change, all related settings, workflow actions, and other features have also been renamed and now use the word task instead of to-do. The new name better reflects the purpose of the page and enhances clarity.

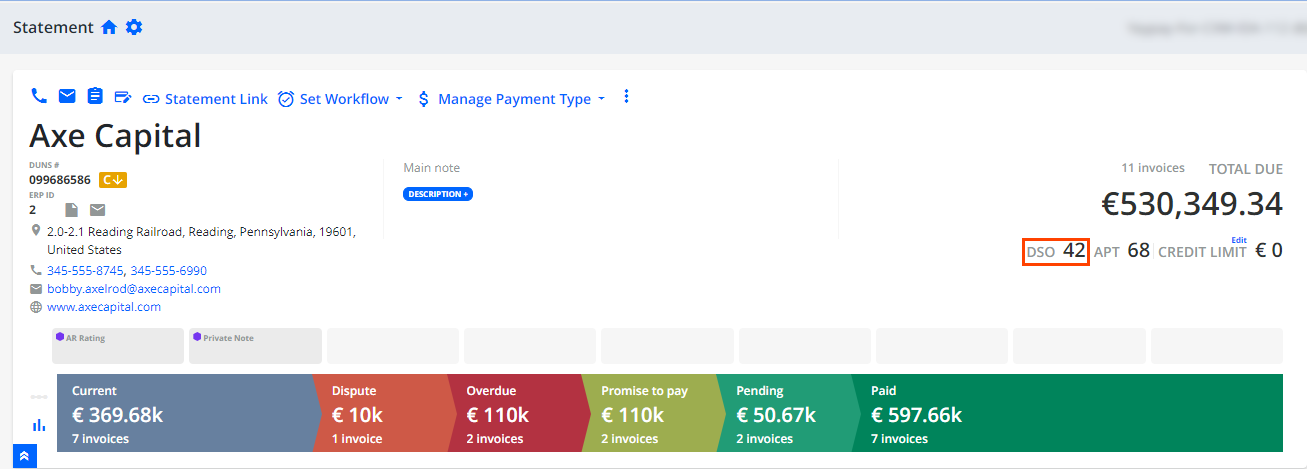

Displaying the Days Sales Outstanding Value

To provide you with a better overview of the average time it takes your company to collect payments from your customers, we now display the Days Sales Outstanding (DSO) value on the Aging Report, Statement, and Invoices pages.

On the Statement page, the DSO value is shown in the header. On the Aging Report and Invoices pages, you can easily view the DSO value in a new column that you can add to the grid.

For more details, see the DSO section.

Credit

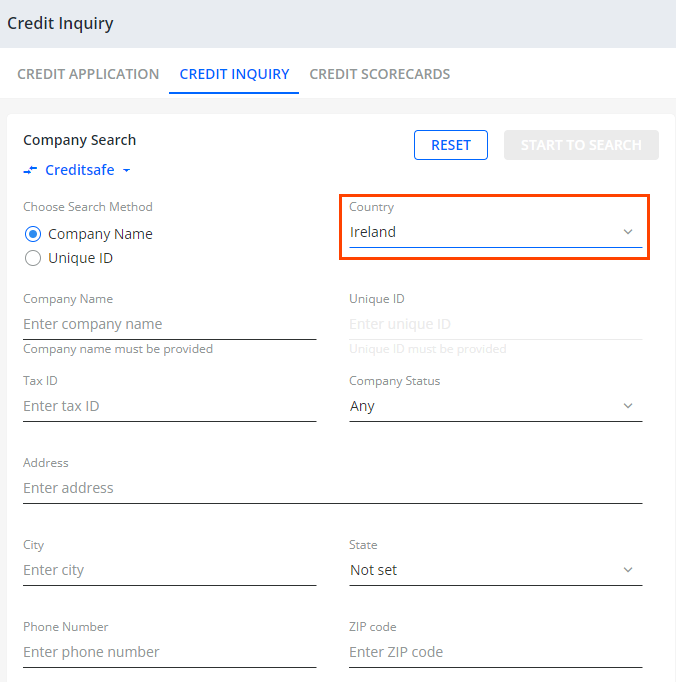

Creditsafe – International Reports

We have enhanced the integration between YayPay and Creditsafe, allowing you to run credit checks on businesses located not only in the United States, but also in France, Canada, Germany, Ireland, and the United Kingdom.

For more information about this functionality, see the Using the Credit Inquiry Search section.

Payment Providers

Stripe – Simplified ACH Payments

We have simplified the process of making ACH payments via Stripe. Now, you no longer need to use the third-party Plaid functionality. When paying invoices using Stripe's ACH payment method, you can follow a simple payment process flow.

For more information, see Stripe Payments and Integration section.

Worfklow Features

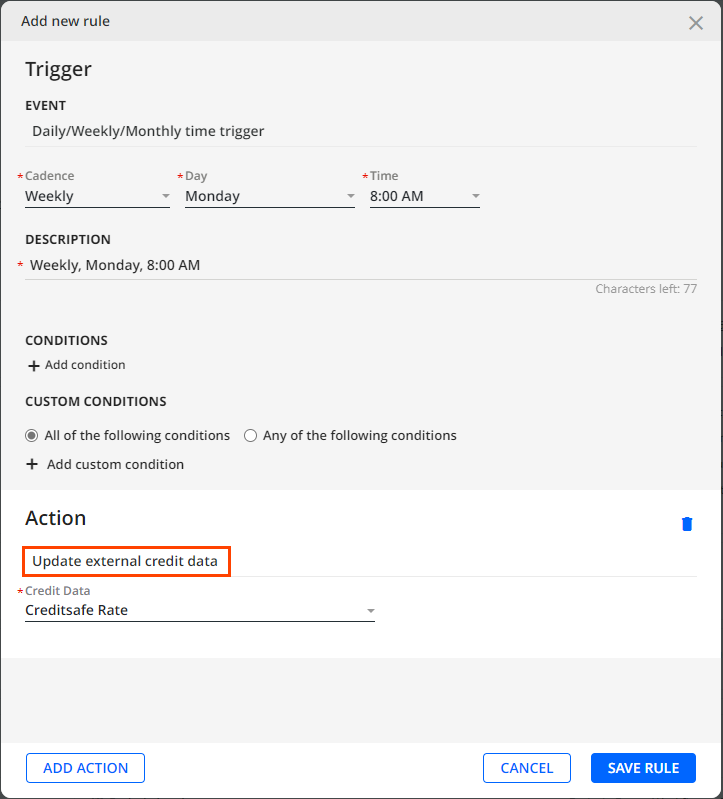

Update External Credit Data for Creditsafe

We have added a new action called Update external credit data which is available for both workflow and global rules events.

With the Update external credit data action, external credit data of the Creditsafe inquiry provider will be automatically updated whenever a specific event occurs.

For this action to be visible in the dropdown, you must first configure it.

After the specified event occurs, the Credit Score and Creditsafe Rate on the Statement page will be automatically updated. Additionally, this update will also be logged on the CREDIT SCORE LOG tab located at the bottom of the Statement page.

For more details, see the Rules Engine Actions section.

**This feature requires the Advanced Credit module.**

Business and Account Settings Features

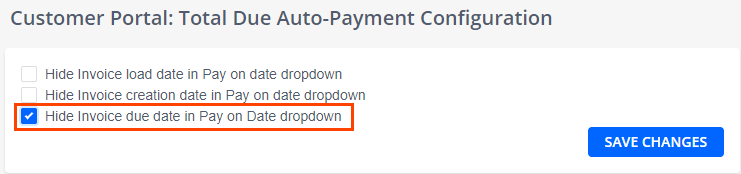

Hide Invoice Due Date in Pay on Day Dropdown

We have further enhanced the possibility to customize the options for the Pay on Day drop down menu on the Customer Portal web page. You can now hide the invoice due date option, providing a streamlined payment experience for your customers.

For this purpose, we have designed the new Customer Portal: Total Due Auto-Payment Configuration panel in Settings | Business, where you can find all the related options, including the new Hide Invoice due date in Pay on Date dropdown check box.

For more details, see the Auto Payments section.

Integration Features

External ID Available in transaction.csv File

To ensure correct payment identification during CSV synchronization, you can now include the new externalId field in the transaction.csv file.

Providing the externalId field in the CSV file ensures that once a payment is pushed from YayPay to the ERP, it will be represented as a single entity with a unique External ID.

For more details about the CSV connector, see the CSV ZIP File Requirements section.

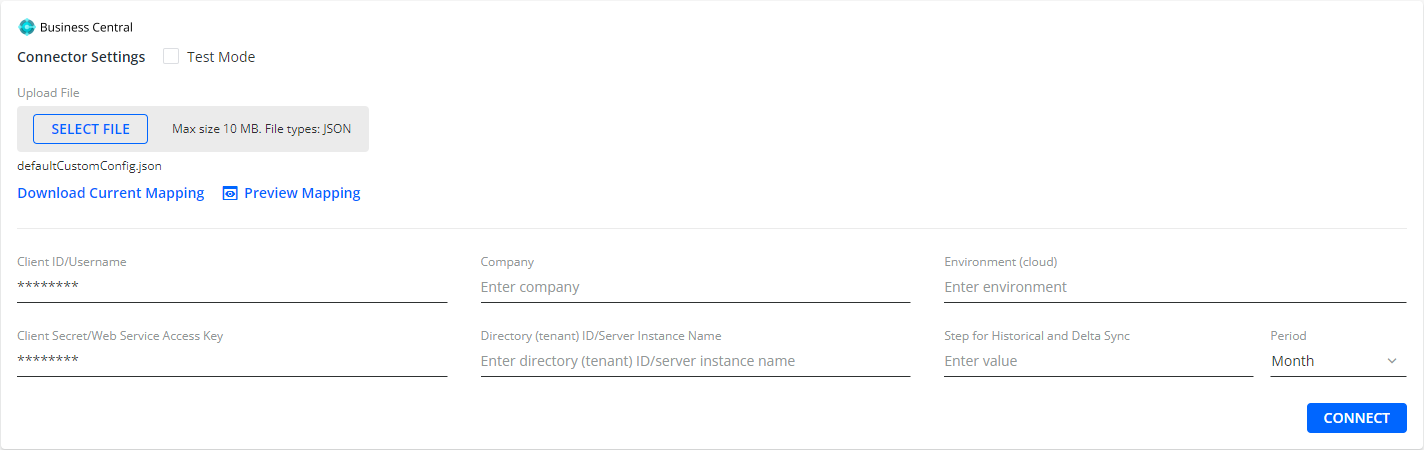

Business Central Connector

We have further improved the Business Central connector to support data synchronization from the on-premise version of Business Central. This enhancement allows you to integrate data sources, whether they are in the cloud or on-premise version.

Additionally, the connector now supports synchronizing unapplied and reversed payments. During synchronization, YayPay identifies and synchronizes new or updated data by checking for changes in the Customer Ledger Entries Details journal in your Business Central. Thus, documents are synchronized based on the freshness of the data entries, rather than being restricted to the time window between the last synchronization and today's date.

For more details about integrations with Business Central, see the Business Central: Configure Account for YayPay Integration section.

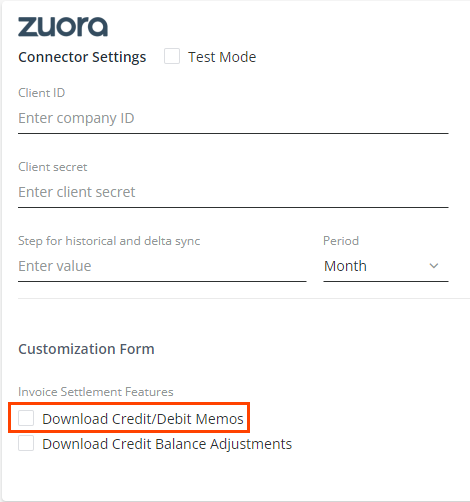

Zuora – Calculating Credit Memo Refunds

We have enhanced the Zuora connector to improve the calculation of the applied amount for credit memos, especially when a refund is processed.

To ensure accuracy, YayPay now calculates the unpaid amount of the credit memo by deducting the refund amount from the total credit memo amount and then adding the applied amount. If no amount has been applied, YayPay sets the applied amount equal to the refund amount.

For more details, see the Configuring Zuora Account for YayPay Integration section.