Characteristics

Using REPAY you can pay both by credit card and ACH.

While credit card payments via REPAY are available in all currencies (USD and non-USD), ACH payments can be submitted only in USD.

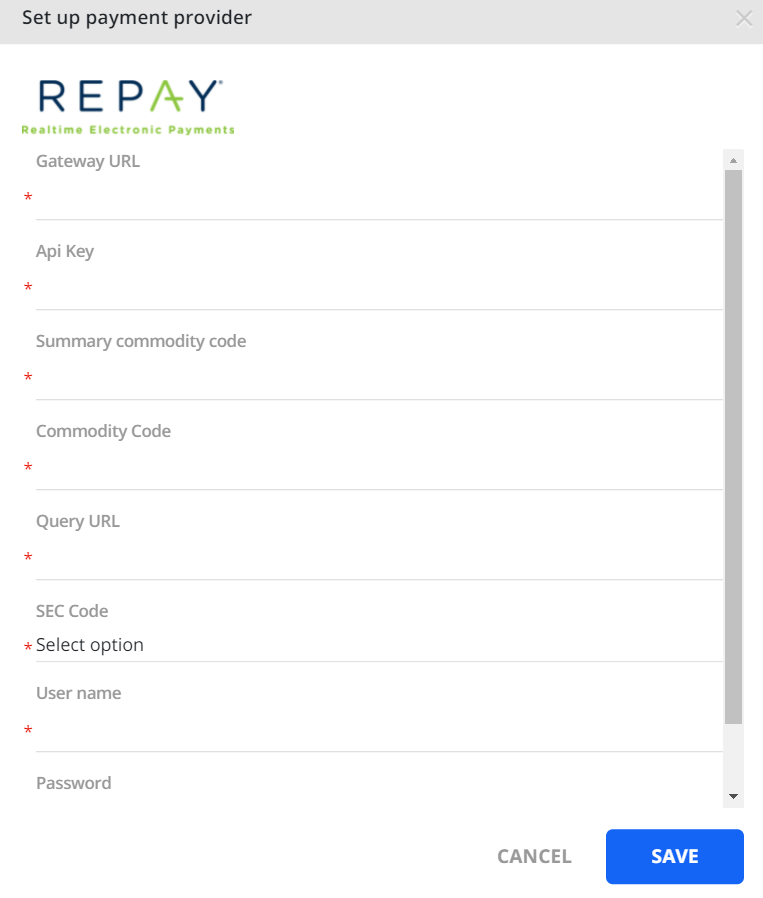

How to set up REPAY

1. Go to Settings > Payments/Credits > REPAY section

2. Click SET UP

3. Populate the Gateway URL: https://secure.apspaymentgateway.com/api/v2/three-step

3. Populate the Gateway URL: https://secure.apspaymentgateway.com/api/v2/three-step

4. Populate the rest of the mandatory fields obtained from the payment provider

5. Click "SAVE".

How to connect REPAY

Once you set up the REPAY payment service provider, you can connect to it on the Integrations page: go to Settings > Payments/Credits and find REPAY in the PSPs list.

Click "CONNECT".

After this, the "DISCONNECT" button appears, which can be used to disconnect REPAY.

After this, the "DISCONNECT" button appears, which can be used to disconnect REPAY.

Ability to work along with other PSPs

Being a primary payment service provider REPAYcan be connected along with any of the secondary PSPs.

For a detailed description of how REPAY works when connected simultaneously with other PSP, see the links below:

1) REPAY + NMI: https://yaypay.helpjuice.com/en_US/payments/955336-nmi-payments-and-integration

2) REPAY + GoCardless: https://yaypay.helpjuice.com/en_US/payments/gocardless-integration

3) REPAY + Flywire: https://yaypay.helpjuice.com/en_US/payments/951427-flywire-payments

Test Transactions

This section lists some of the test credit card and ACH payment methods provided by REPAY when using the REPAYTest Gateway.

Transactions can be submitted using the following information:

| Visa: | 4111111111111111 |

| MasterCard: | 5431111111111111 |

| Discover: | 6011601160116611 |

| American Express: | 341111111111111 |

| Diner's Club: | 30205252489926 |

| JCB: | 3541963594572595 |

| Maestro: | 6799990100000000019 |

| Credit Card Expiration: | 10/25 |

| Account (ACH): | 123123123 |

| Routing (ACH): | 123123123 |

REPAY Payment Messages and Errors

This is a list of the possible messages/errors that your customer might receive when they attempt to make a payment.

Result Code Table

| 100 | Transaction was approved. |

| 200 | Transaction was declined by processor. |

| 201 | Do not honor. |

| 202 | Insufficient funds. |

| 203 | Over limit. |

| 204 | Transaction not allowed. |

| 220 | Incorrect payment information. |

| 221 | No such card issuer. |

| 222 | No card number on file with issuer. |

| 223 | Expired card. |

| 224 | Invalid expiration date. |

| 225 | Invalid card security code. |

| 226 | Invalid PIN. |

| 240 | Call issuer for further information. |

| 250 | Pick up card. |

| 251 | Lost card. |

| 252 | Stolen card. |

| 253 | Fraudulent card. |

| 260 | Declined with further instructions available. (See response text) |

| 261 | Declined-Stop all recurring payments. |

| 262 | Declined-Stop this recurring program. |

| 263 | Declined-Update cardholder data available. |

| 264 | Declined-Retry in a few days. |

| 300 | Transaction was rejected by gateway. |

| 400 | Transaction error returned by processor. |

| 410 | Invalid merchant configuration. |

| 411 | Merchant account is inactive. |

| 420 | Communication error. |

| 421 | Communication error with issuer. |

| 430 | Duplicate transaction at processor. |

| 440 | Processor format error. |

| 441 | Invalid transaction information. |

| 460 | Processor feature not available. |

| 461 | Unsupported card type. |

Troubleshooting

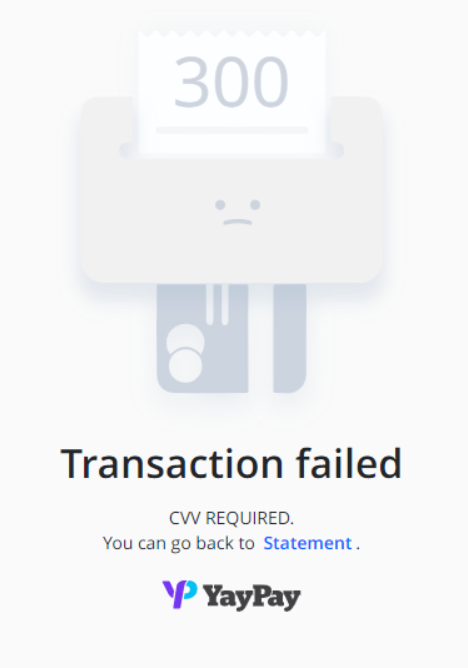

|

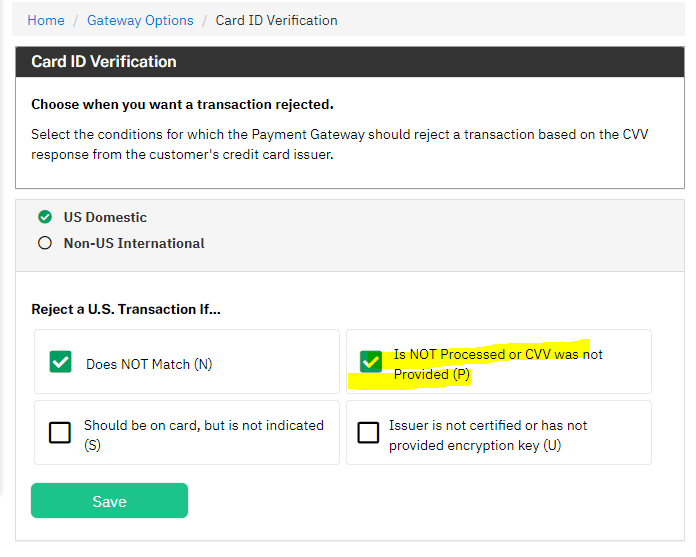

Possible reason: YayPay <> REPAY integration does not support a setting that enables the CVV requirement the merchant has placed on the transaction (not tokenization). YayPay does not store any cardholder data (credit card number, expiration date, and CVV) because of PCI-DSS compliance. All this data is sent to the provider after submission, and YayPay does not use CVV with the transaction. Troubleshooting: disable this setting on your Payment Gateway side (Gateway > Settings > Security Options > Card ID Verification):  |

Triggering Errors in Test Mode

To cause a declined message, pass an amount less than 1.00.

To trigger a fatal error message, pass an invalid card number.

To simulate an AVS match, pass 888 in the address1 field, 77777 for zip.

To simulate a CVV match, pass 999 in the cvv field.