This document provides a summary of the most significant new features, enhancements, and changes we have made to the software. For further details regarding Localization, Supported Software or Recommended Limits, review the Accounts Receivable by YayPay Release Notes.

Cash Application Features

Enhanced Processing of Remittance Mailbox Emails

We have extended two essential features to support remittances created from Remittance Mailbox emails:

- Parsing Payment Numbers from Remittance Emails – YayPay now intelligently parses payment numbers from Remittance Mailbox emails, ensuring accurate and efficient processing. This feature allows for seamless identification and extraction of payment numbers from the emails, streamlining your cash application process.

- Auto-Allocation Using Remittance-Payment Association – YayPay now automatically allocates payments identified from Remittance Mailbox emails to their corresponding invoices. This feature reduces manual allocation efforts, providing automated and accurate payment allocation.

Creating Remittances from Emails without Valid Payment Numbers

We have significantly improved how YayPay processes remittance emails which contain no valid payment numbers.

This feature simplifies your remittance management, reducing manual effort, bringing greater efficiency to your financial processes.

To learn how this feature works, see the Handling Remittance Emails without Validated Payments section of YayPay User Manual.

Allocating Remittances from Payment Platforms

YayPay now has the capability to automatically parse important invoice-related data (such as Document #, Remit Allocated Amount, and Remit Discount Taken) from Paymerang® emails.

With this update, YayPay is now able to automatically allocate remittances (created from email remittances received from Paymerang®) to an invoice.

This enhancement further streamlines the cash application process, saving valuable time and resources for your business. To learn more about how this feature works, refer to the Allocating Remittances to Invoices section of YayPay User Manual.

Processing Email Remittances from Payment Platforms – Extended

YayPay has enhanced its capabilities to process email remittances received from payment platforms.

With this update, YayPay can now recognize and parse email remittances from the BILL® payment platform.

That simplifies the process of creating remittance records in the Cash Application module from such email remittances, eliminating the need for manual data entry, ensuring accuracy, and improving efficiency.

YayPay utilizes the predefined structure of payment platform emails to parse essential data, populating the created remittance records with that data.

For more information about this feature, see the Parsing Email Remittances Received from Payment Platforms section of YayPay User Manual.

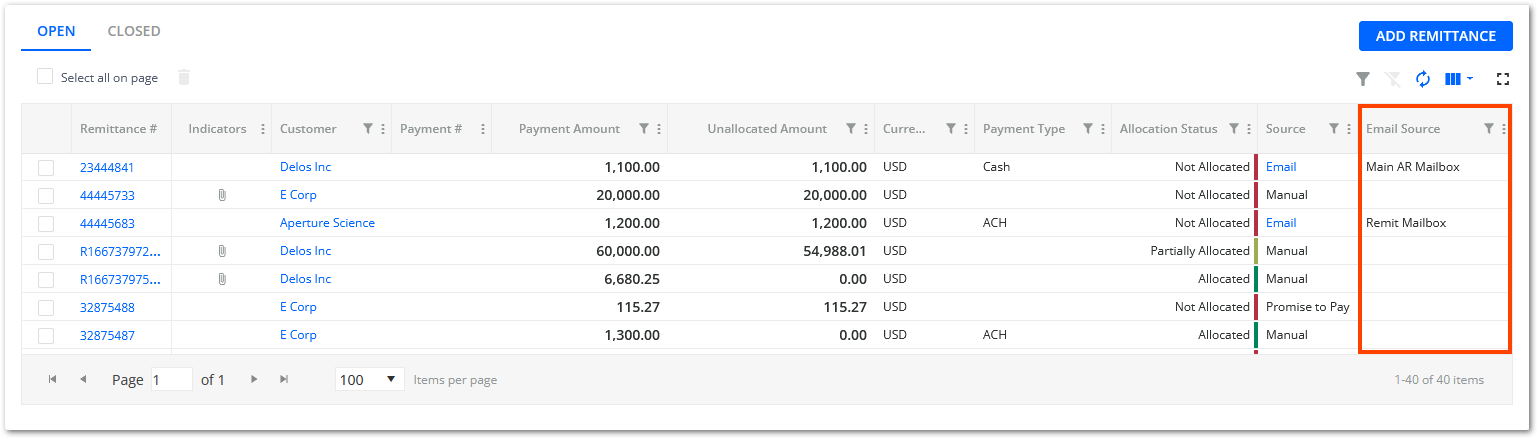

Simplified Remittance Search

To make it easier for you to find relevant remittances, we have enhanced the open and closed remittance grids. We have introduced a new column called Email Source, which provides information about the source of each remittance.

If a remittance was created from an email, the value in the new column will help you quickly identify and differentiate between remittances based on their email source:

- Main AR Mailbox – Indicates that a remittance was created from an email (labeled as REMITTANCE ADVICE) received on the Communications page.

- Remit Mailbox – Indicates that a remittance was created from an email received in the remittance mailbox.

Simplified Payments Upload

We have enhanced YayPay's Cash Application module to simplify the process of uploading payment files into the system.

With this update, when uploading payment files into the Cash Application module, YayPay now successfully creates payment records for amounts containing the following currency signs:

- € (Euro)

- $ (US Dollar)

- £ (British Pound)

- ¥ (Japanese Yen)

- ₹ (Indian Rupee)

- C$ or CA$ (Canadian Dollar)

General Features

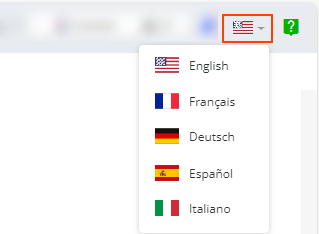

YayPay in Italian Language

We understand the importance of providing a user-friendly experience for our users. We have expanded our supported languages by adding Italian to the list of available languages in the YayPay user interface.

To switch the user interface to your preferred language, click on the flag icon located in the top right corner of the page.

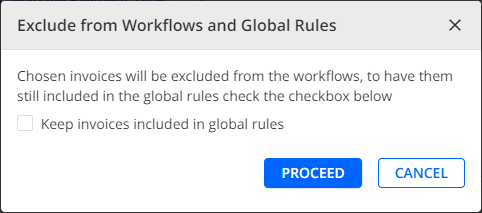

Exclude Invoice From Workflows and Global Rules

To provide you with greater flexibility when manually excluding invoices from workflows and global rules, we have enhanced the Exclude from Workflow action on the Invoices and Statement pages, as well as the Exclude Invoice From All Workflows action on the Communications page. Additionally, we have renamed these actions to Exclude invoice from Workflow and Global Rules to better align with their purpose. With this action, you can now decide whether to exclude the selected invoices from both workflows and global rules, or only workflows.

This is done by checking the Keep invoices included in global rules check box in the Exclude from Workflows and Global Rules dialog.

For more details, see the relevant sections on the Statement, Invoices and Communications pages.

Customer Portal

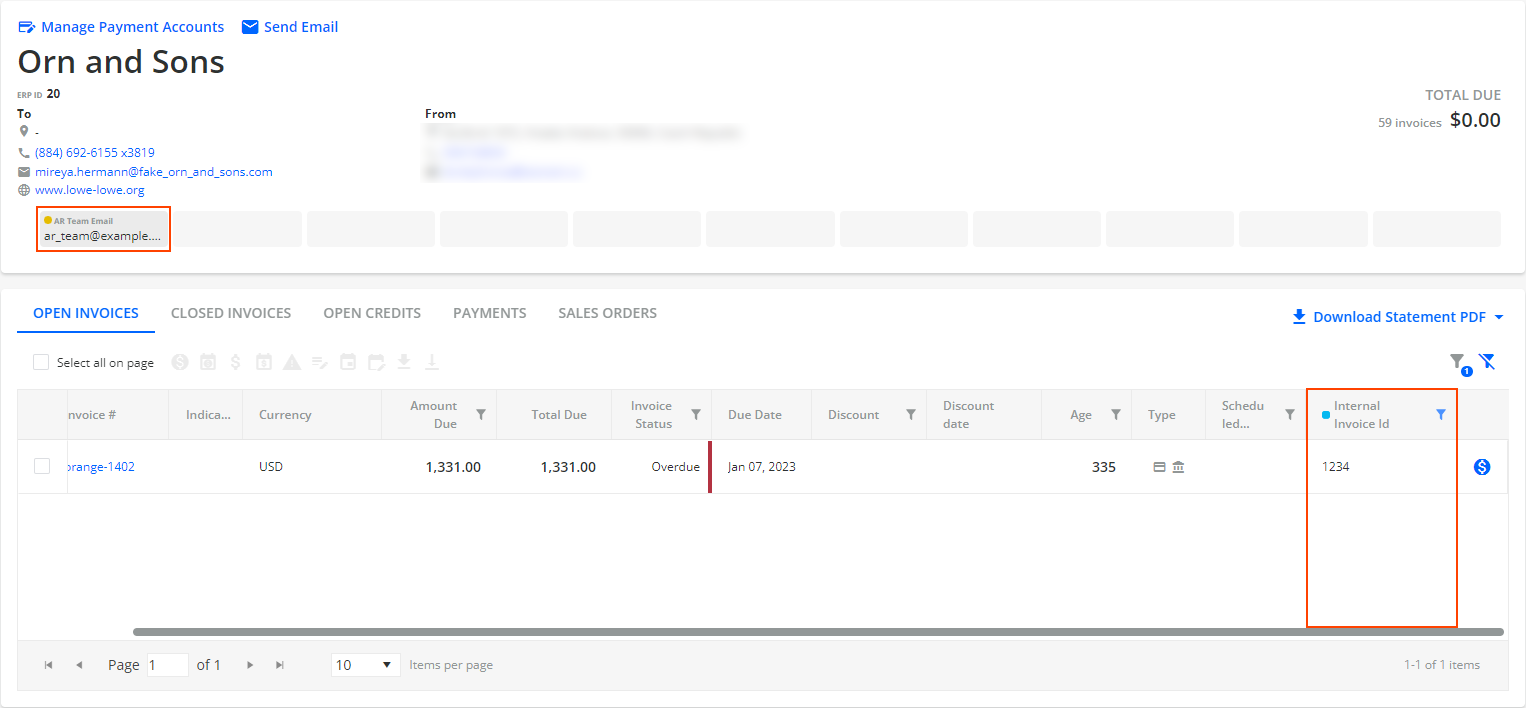

Customer Portal - Display Custom Fields

You can enhance the invoice information displayed to customers on their Customer Portal web page by showing system custom fields created in YayPay.

As a result, customer level system custom fields are displayed in the header, while invoice level custom fields are shown in the grid on the OPEN INVOICES and CLOSED INVOICES tabs.

Additionally, you can sort and filter the column's content based on the values of the respective invoice level custom fields.

For more details, read the Customer Portal - Displaying Custom Fields section.

Disputes

Set a Dispute Assignee

When handling open disputes, you now have the option to manually select and assign a dispute assignee.

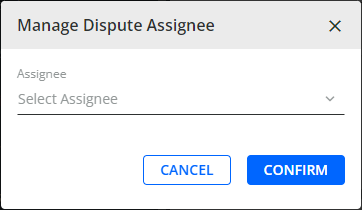

To do so, use the new Manage Dispute Assignee icon located above the grid on the Disputes page. In the dialog that opens, you can choose an assignee from a list of active users categorized by their roles.

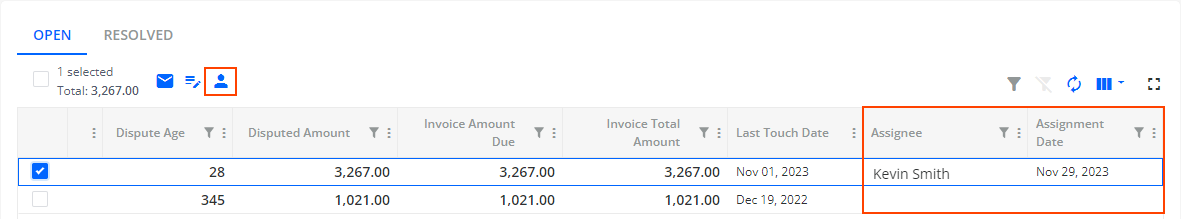

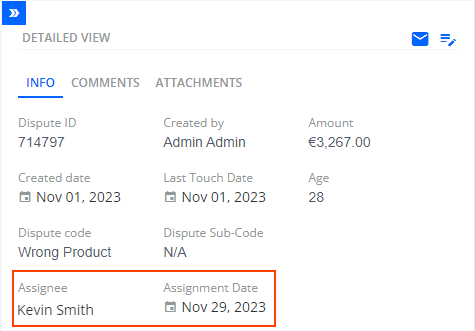

After choosing an assignee, the name and date of assignment will be displayed in the new Assignee and Assignment Date columns that you can add to the table on the Disputes page. In addition, you can sort and filter the content in both columns.

The same information is also displayed in the DETAILED VIEW panel on the right.

For more information about disputes, see the Disputes page.

Workflow Features

Set a Dispute Assignee

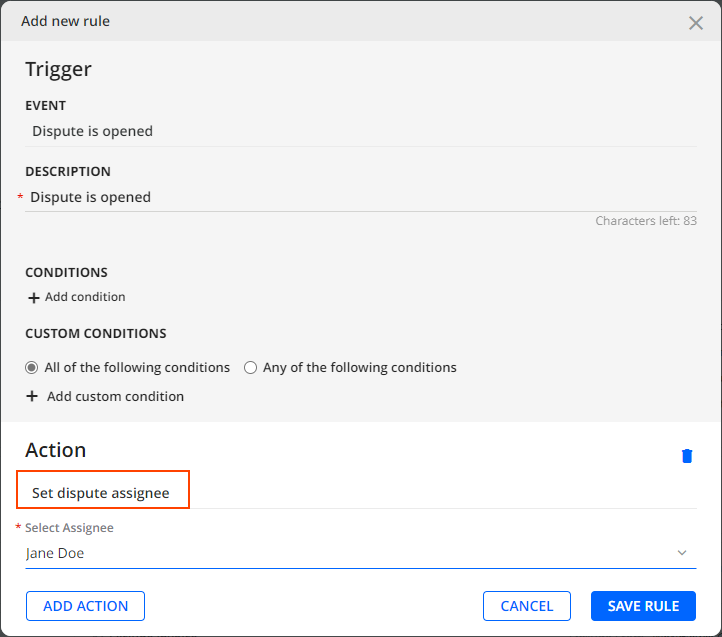

We have added a new Set dispute assignee action for the following events: Dispute is opened, Dispute is updated , X days after dispute created and X days after dispute updated.

With the Set dispute assignee action, you can select a dispute assignee who will be automatically assigned to handle a dispute when a specific event occurs. This ensures that the appropriate person is assigned to handle the dispute promptly.

After the specified event occurs, the chosen assignee and the date of assignment will be displayed on the Disputes page in the Dispute Assignee and Dispute Assignment Date columns which you can add to the grid.

For more details, see the Rules Engine Actions section.

Business and Account Settings

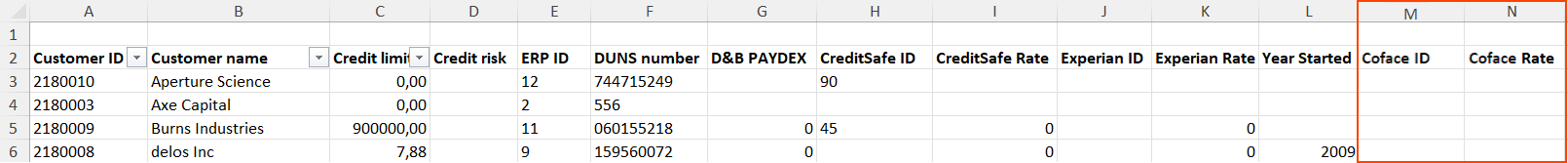

Credit Mapping Excel File Enhanced

When you download the Credit Mapping Excel file, it now provides additional information about the CoFace credit inquiry provider. More specifically, the file now contains the Coface ID and Coface Rate columns.

By utilizing this file, you can efficiently Manage Credit Limit inside YayPay.

For more information, see Excel Mapping.

Credit

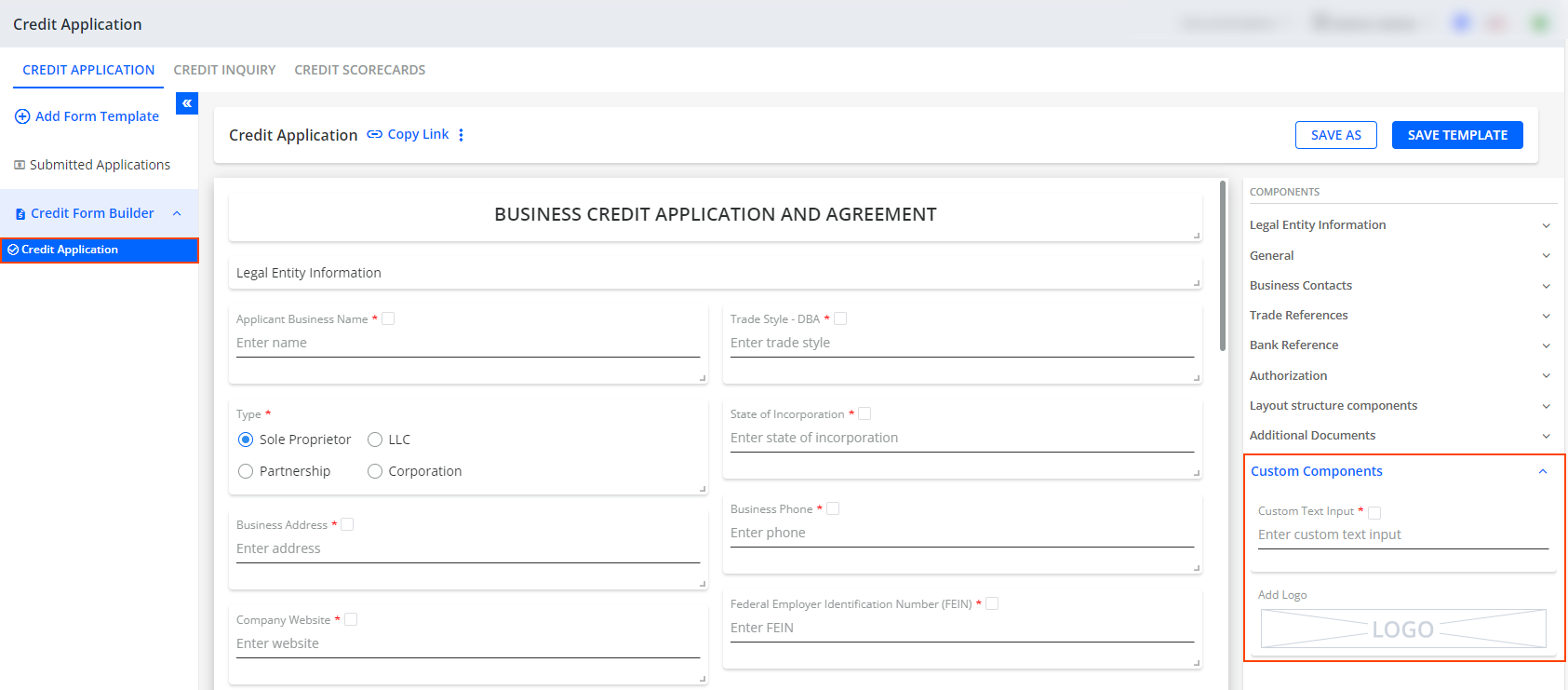

Use Custom Components in Credit Form Builder

When designing a credit application form, you can now include custom text input fields or upload a logo that will be displayed on the form. Thus, you can customize and enhance the branding of the credit application form, ensuring it aligns with your requirements.

You can find these newly added components in the Custom Components category on the COMPONENTS panel.

For more information, see Credit Form Builder.

Payment Providers

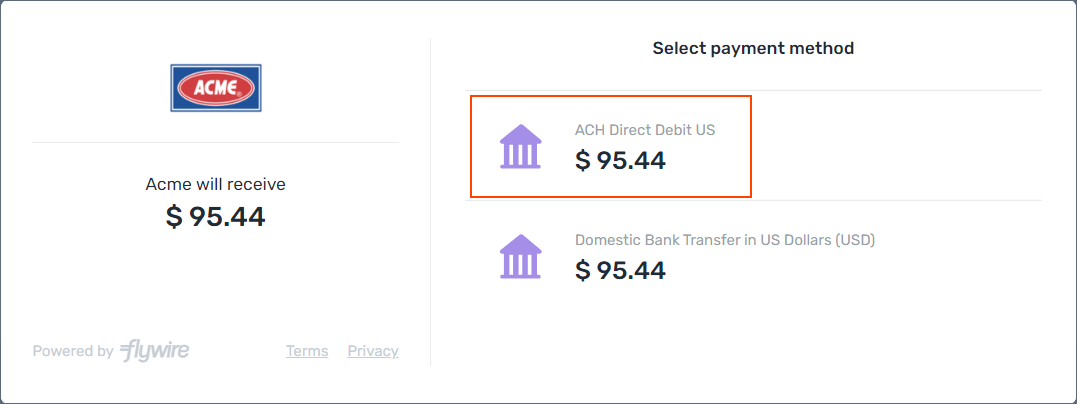

FlyWire – Pay Using Direct Debit

When paying invoices with FlyWire's ACH payment method, you can now choose direct debit as a payment option.

By selecting ACH Direct Debit US, the amount is deducted from your bank account on a given date. This payment method is widely used for recurring payments, like subscriptions or bills, ensuring a smooth and efficient experience for both businesses and customers.

For more information, see Behavior of YayPay Payments Powered by FlyWire section.

Reporting

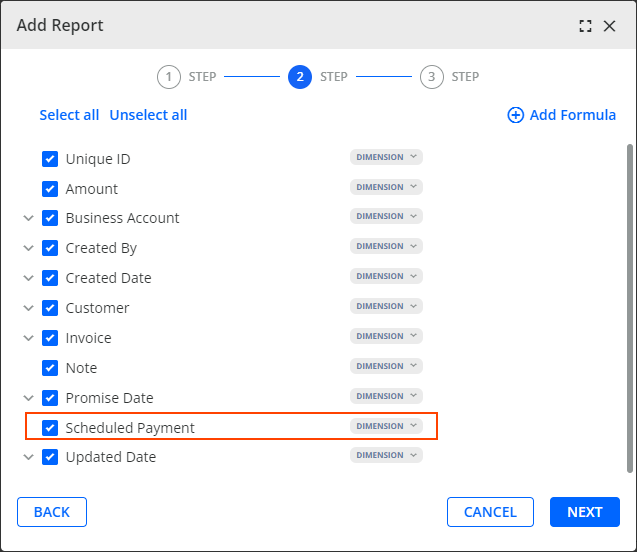

Scheduled Payment Column In Reports

Enhance your financial management by adding the Scheduled Payment column to your reports. By staying informed about the scheduled payment dates, you can effectively plan and organize your finances, ensuring timely bill payments, and more.

You can include this column in reports created with the Promise to Pay Data Source.

After creating a report containing a Scheduled Payment column, you can add the column to dashboards, charts, use it in formulas and its filters, or export the report containing the column as an Excel file.

In reports, the column can be sorted and filtered.

For more details, read the Reporting Section Sources article.

Integration Features

CSV Connector - No Size Limit for PDF Uploads

YayPay has removed the size limit for invoice PDF files that can be uploaded into YayPay from an FTP server using the CSV Connector.

This update provides more flexibility and makes it easier to manage and synchronize your invoices.

REST API Features

New Services for Uploading Large PDFs

We have developed new services, allowing you to upload PDF files into YayPay via the REST API without any limitations on the file size: